Google DOJ illegal monopoly remedies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This analysis delves into the historical context of Google’s rise to dominance, exploring the DOJ’s concerns about its practices, potential remedies, economic impacts, and legal precedents. We’ll examine how these remedies could affect Google’s services and the wider tech industry.

The DOJ’s investigation into Google’s alleged monopolistic practices highlights the complexities of regulating powerful tech companies in the digital age. Understanding the historical context, the specific accusations, and the potential solutions is crucial to grasping the potential consequences for consumers, competitors, and the future of the digital marketplace.

Historical Context of Google’s Dominance

Google’s ascent to digital dominance wasn’t a sudden explosion, but a carefully orchestrated series of strategic moves and technological innovations. From its humble beginnings as a research project at Stanford University, Google has evolved into a multifaceted corporation shaping the way we interact with the internet and access information. This evolution is inextricably linked to the changing landscape of internet regulation and competition.The company’s success story is marked by key acquisitions, product development, and a persistent focus on user experience, resulting in its current position as a global technology giant.

Understanding Google’s historical trajectory is crucial to comprehending its current market power and the ongoing debate surrounding its role in the digital economy.

Early Years and Core Services

Google’s initial focus was on developing a search engine that could effectively organize and retrieve information from the rapidly expanding web. Its PageRank algorithm, a revolutionary approach to ranking web pages, distinguished Google from other search engines, allowing it to quickly gain market share. The simplicity and effectiveness of its interface proved highly appealing to users, rapidly making it the dominant search engine.

This foundation laid the groundwork for Google’s future expansion.

Key Acquisitions and Product Evolution

Google’s expansion into various digital services was largely facilitated by strategic acquisitions. These acquisitions often aimed to integrate complementary technologies and services into Google’s existing platform, strengthening its position in different sectors. Examples include YouTube (video sharing), Android (mobile operating system), and Waze (navigation). These acquisitions played a significant role in diversifying Google’s offerings and expanding its user base.

The DOJ’s investigation into Google’s alleged illegal monopoly practices is a hot topic right now. It’s crucial for companies to build trust and credibility, which can be challenging in a competitive market. This is why focusing on ethical practices and transparency is key, like the 18 best ways to create a brand that is honest and trustworthy, outlined in this helpful guide: 18 best ways create brand honest trustworthy.

Ultimately, a strong brand reputation is essential to navigating the complexities of today’s business climate, especially when facing potential antitrust issues like those Google is currently facing.

The integration of these acquired entities allowed Google to create a comprehensive ecosystem of products and services, enhancing user experience and solidifying its position as a one-stop shop for digital needs.

Regulatory Landscape Evolution

The regulatory landscape surrounding technology monopolies has undergone considerable change during Google’s rise to prominence. Initially, the focus was primarily on preventing anti-competitive practices in traditional markets. As technology evolved and companies like Google expanded their reach, the regulatory focus shifted to addressing concerns about digital dominance and its impact on competition. The debate over the appropriate regulatory response to large tech companies became increasingly complex, reflecting the challenges of regulating innovative industries.

This regulatory evolution highlights the difficulty of adapting legal frameworks to keep pace with rapid technological advancement.

Market Share Comparison

| Year | Google Search Market Share (%) | Other Major Competitors | Notes |

|---|---|---|---|

| 2000 | N/A | AltaVista, Yahoo! | Google’s early years; not a major player yet. |

| 2005 | ~50% | Yahoo!, MSN | Google’s substantial dominance in search begins. |

| 2010 | ~65% | Yahoo!, Bing | Continued growth and substantial market share. |

| 2015 | ~90% | Bing, DuckDuckGo | Dominant position in search, significant lead. |

| 2020 | ~90% | Bing, DuckDuckGo | Maintained strong market share. |

Note: Exact figures may vary depending on the source and methodology used for market share calculation. Data is presented as a general overview.

DOJ Concerns Regarding Google’s Practices

The Department of Justice (DOJ) has launched an investigation into Google’s practices, alleging anti-competitive behavior that harms consumers and competitors. This scrutiny stems from the belief that Google’s dominant position in search, advertising, and other online services allows it to stifle innovation and limit consumer choice. The DOJ’s concerns are multifaceted and hinge on Google’s alleged control over critical online platforms.The DOJ’s investigation focuses on several key areas, aiming to determine if Google has leveraged its market power to unfairly disadvantage competitors and limit consumer options.

This includes evaluating whether Google’s practices have created a closed ecosystem that hinders innovation and whether it has used its dominant position to unfairly favor its own products and services.

Specific Anti-Competitive Practices Alleged

Google’s alleged anti-competitive practices include several key areas of concern. These practices extend beyond simply having a large market share, focusing on how Google uses that share to disadvantage competitors. These concerns are rooted in the belief that Google’s dominance has led to a less competitive market, ultimately harming consumers.

- Predatory Pricing: The DOJ may allege that Google uses predatory pricing strategies to drive competitors out of the market. This involves setting prices below cost for certain products or services, creating an unsustainable competitive landscape for smaller players.

- Bundling and Tying: Google’s practices in bundling its services, like search with other products, may be viewed as tying. This can restrict consumer choice and limit the ability of competitors to offer alternative products or services.

- Algorithm Manipulation: The DOJ may investigate whether Google manipulates its search algorithms to favor its own products and services. This could manifest in giving higher rankings to Google-owned products or services in search results.

- Data Advantages: Google’s vast data collection practices, which are integral to its business model, could be seen as granting an unfair advantage over competitors who lack access to the same breadth and depth of data.

- Anti-Competitive Acquisitions: The DOJ might also examine whether Google’s acquisition of certain companies or technologies has stifled innovation and reduced competition in specific sectors.

Harms to Consumers and Competitors

These alleged anti-competitive practices can cause significant harm to consumers and competitors. The DOJ believes that these harms stem from a reduced level of competition, limiting consumer choices and options.

- Reduced Consumer Choice: A diminished competitive landscape can result in fewer options for consumers, leading to higher prices, lower quality products, and fewer innovative services.

- Higher Prices: With fewer competitors, prices for goods and services may increase, as companies lack pressure to compete effectively.

- Reduced Innovation: A lack of competition can hinder innovation, as companies lack incentives to develop new products or services to attract customers.

- Stifled Competition: The DOJ believes Google’s practices have created an environment where competitors find it difficult to compete, leading to a less dynamic and innovative market.

Economic Theories Underpinning the DOJ’s Case

The DOJ’s case against Google will likely rely on economic theories that explain how Google’s practices can harm competition and consumers. These theories emphasize the importance of maintaining a healthy competitive environment.

The DOJ’s investigation into Google’s alleged illegal monopoly practices is fascinating. It’s clear that the company’s dominance in search and advertising raises some serious concerns, especially when you consider how this impacts smaller competitors. This naturally leads to the topic of how companies track user engagement across different touchpoints. Understanding how users interact with marketing channels, like through cohort and multi touch attribution , is crucial in determining effective strategies.

Ultimately, the DOJ’s actions are about ensuring a level playing field for everyone, promoting healthy competition, and avoiding the stifling of innovation.

“A key economic principle underpinning the case is the concept of market power. A firm with significant market power can engage in anti-competitive practices, which can harm consumers.”

The DOJ’s case may use various economic theories, including those related to network effects, data advantages, and the impact of market concentration.

How These Practices Stifle Innovation and Choice

Google’s alleged practices can stifle innovation and choice in the market by creating barriers to entry and discouraging competition. The result is a market where innovation is stifled and consumers have limited options.

- Barriers to Entry: Google’s dominance creates significant barriers for new companies entering the market. This makes it difficult for competitors to gain a foothold, leading to a less dynamic market.

- Discouraging Competition: The alleged practices discourage other companies from entering the market or competing effectively against Google’s dominant position.

Likely Legal Arguments Presented by the DOJ

The DOJ is likely to present several legal arguments to support its case against Google. These arguments are central to the investigation’s success.

| Argument | Description |

|---|---|

| Monopoly Power | The DOJ will likely argue that Google possesses significant monopoly power in various online markets, giving it the ability to engage in anti-competitive practices. |

| Exclusionary Conduct | The DOJ will likely argue that Google’s practices are exclusionary, designed to prevent competitors from entering or competing effectively in the market. |

| Harm to Consumers | The DOJ will likely demonstrate how Google’s practices harm consumers by limiting choice, increasing prices, and hindering innovation. |

| Unfair Advantage | The DOJ may highlight how Google’s vast data collection and algorithmic control provide an unfair advantage over competitors. |

Potential Remedies for Alleged Anti-Competitive Behavior

The Department of Justice (DOJ) investigation into Google’s alleged anti-competitive practices has highlighted the potential for significant remedies. These remedies aim to address concerns about Google’s dominance in search, advertising, and other digital markets, ultimately fostering a more competitive landscape. The effectiveness of these measures will be crucial in preventing Google from regaining a monopolistic position in the future.The DOJ’s potential remedies will likely center on breaking up Google’s interconnected ecosystem of services.

This is done to prevent the unfair advantage Google enjoys due to the tight integration of its products, which can lead to stifled innovation and higher prices for consumers. The goal is to create a more level playing field, allowing smaller competitors to flourish and fostering greater competition.

Potential Divestiture Scenarios

The DOJ might pursue divestitures of specific Google products or services, separating them from the core Google platform. This strategy aims to limit the unfair advantage Google gains from its integrated services. This separation will create independent entities, allowing competitors to effectively challenge Google’s market dominance. Examples of such divestitures include splitting Google Search from other services like Android or YouTube.

This can be crucial in leveling the playing field, particularly if the divestiture includes access to critical data or resources previously tied to the Google ecosystem.

Impact on Google’s Business Model

Divestiture of key products or services would significantly impact Google’s business model. For example, separating Google Search from other Google services would disrupt the current revenue stream by diminishing the potential for cross-promotion and data sharing. This could lead to a decline in revenue and potentially lower profitability, impacting Google’s market position and competitive edge. Google’s ability to offer bundled services and leverage data across its platforms would be substantially reduced.

The separation of Google Search from Android, for instance, would eliminate the potential for cross-promotion and advertising optimization that benefits from data sharing between services. This would likely necessitate adjustments in advertising strategies and business operations.

Effectiveness of Remedies

The effectiveness of various remedies in preventing future anti-competitive behavior is contingent on several factors. The thoroughness and clarity of the separation of entities, coupled with effective regulatory oversight, are crucial to preventing Google from re-integrating or developing strategies to regain the market dominance it loses. Successful implementation of remedies requires a careful balancing of market needs with the need to protect consumer interests and ensure fair competition.

Comparison of Remedies

| Remedy | Potential Impact on Google | Effectiveness in Preventing Future Anti-Competitive Behavior |

|---|---|---|

| Divestiture of Search | Significant reduction in cross-promotional opportunities, alteration of revenue streams | High, provided regulatory oversight is robust and Google’s ability to use data is effectively constrained. |

| Divestiture of Android | Loss of access to a significant mobile ecosystem, affecting mobile device revenue and operating system market share | Moderate to High, dependent on how the divestiture affects Google’s ability to leverage data and develop alternative strategies. |

| Divestiture of YouTube | Loss of access to a massive video platform, impacting Google’s advertising revenue and ecosystem of connected services | Moderate, with the effectiveness contingent on the success of competing video platforms in gaining market share. |

Economic Impact of Google’s Actions

Google’s dominance in the digital market, while generating substantial economic benefits, has also raised concerns about potential anti-competitive practices. This section explores the potential economic consequences of these alleged practices, focusing on consumer welfare, smaller businesses, innovation, and potential market outcomes following potential remedies. A comprehensive understanding of these impacts is crucial for evaluating the overall health and fairness of the digital economy.

Potential Consequences for Consumer Welfare

Google’s alleged practices could lead to reduced consumer choice and potentially higher prices. A dominant player with substantial control over various digital platforms might leverage its position to limit competition and stifle innovation, ultimately impacting consumer access to diverse and competitively priced services. This could result in a less vibrant and innovative marketplace for consumers.

Impact on Smaller Businesses and Start-ups

The dominance of a platform like Google could create significant challenges for smaller businesses and startups trying to compete. Google’s powerful search algorithms and advertising platform could create a barrier to entry, making it difficult for smaller companies to reach potential customers. This lack of fair competition could limit opportunities for new businesses and stifle entrepreneurial spirit.

Impact on the Overall Innovation Landscape in the Digital Market

Google’s alleged anti-competitive practices could discourage innovation. Fear of being shut out of Google’s ecosystem could deter companies from developing innovative products and services. This could lead to a stagnation of the digital market, potentially limiting new opportunities for consumers and businesses alike. A healthy digital ecosystem depends on a robust environment for competition and innovation.

Potential Scenarios of Market Outcome After Potential Remedies

The following table illustrates potential scenarios of market outcome after potential remedies, considering the impact on various stakeholders.

| Scenario | Impact on Consumers | Impact on Smaller Businesses | Impact on Innovation | Impact on Google |

|---|---|---|---|---|

| Scenario 1: Successful Remedy Implementation | Increased choice, potentially lower prices, improved access to diverse services. | Fairer competition, increased opportunities for market entry. | Greater innovation, a more vibrant digital market. | Reduced market share, need to adapt to a more competitive environment. |

| Scenario 2: Partial Remedy Implementation | Limited improvements in consumer choice and prices, some access to diverse services may still be hampered. | Mixed outcomes, some smaller businesses may benefit, others may still face challenges. | Limited innovation, a less dynamic digital market. | Maintains substantial market share but faces some restrictions. |

| Scenario 3: Failure to Implement Remedies | Continued limited consumer choice, potentially higher prices. | Continued difficulty for smaller businesses, limited opportunities for market entry. | Reduced innovation, potential stagnation of the digital market. | Maintains dominance and control over the market. |

Case Precedents and Legal Arguments

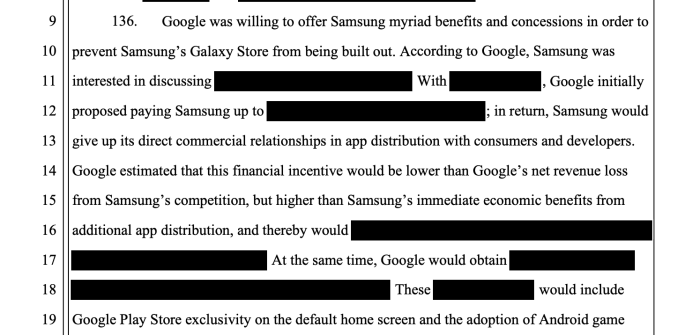

The Department of Justice’s (DOJ) antitrust lawsuit against Google hinges on established legal precedents concerning monopolies and anti-competitive behavior. Understanding these precedents is crucial to assessing the strength of the DOJ’s case and Google’s potential defenses. The case involves complex legal arguments revolving around the breadth and depth of Google’s dominance in the digital sphere.The DOJ alleges Google has used its market power to stifle competition and maintain its dominant position.

This raises questions about the acceptable boundaries of market leadership and the responsibility of companies holding significant market share. Examining past cases provides valuable insight into the legal principles at play and how courts have historically interpreted similar accusations.

Relevant Legal Precedents

Numerous landmark antitrust cases have shaped the legal landscape surrounding monopolies. These precedents provide a framework for evaluating the DOJ’s claims against Google. Cases like

- United States v. Microsoft* (1998) and

- United States v. AT&T* (1974) set crucial precedents, highlighting the potential ramifications of unchecked market dominance.

These cases established the principle that maintaining a monopoly through anti-competitive practices is unlawful. The focus in these cases was on the actions taken by the companies to maintain their dominant position, such as predatory pricing, bundling, and exclusionary contracts. These legal principles will be critically examined in the context of Google’s alleged practices.

DOJ’s Arguments

The DOJ likely argues that Google’s practices in search, mobile operating systems, and advertising violate antitrust laws. They will likely point to specific instances where Google allegedly engaged in anti-competitive behavior. Examples might include Google’s bundling practices, its integration of search with other Google services, and the use of its market dominance to disadvantage rivals. The DOJ’s core argument is that Google’s actions have significantly harmed consumers by limiting their choices and increasing prices.

“The core of the DOJ’s argument rests on the idea that Google’s practices have stifled innovation and competition in the digital sphere, leading to reduced consumer choice and higher prices.”

Google’s Potential Defenses

Google is likely to argue that its actions are justified by factors such as innovation, consumer benefit, and efficiency gains. They might claim that its services offer significant value to users and that competition is still present in the market. They might also emphasize the importance of its technological advancements and the dynamic nature of the digital economy.Google’s arguments may also focus on the concept of ‘interoperability,’ asserting that its practices promote integration and efficiency.

They will likely argue that its integration of search with other services is a natural consequence of technological advancement, benefiting consumers through enhanced functionality.

Comparison of Google Case with Previous Cases

| Feature | Google Case | United States v. Microsoft | United States v. AT&T |

|---|---|---|---|

| Alleged Anti-competitive Behavior | Bundling, Algorithm Design, Integration of Services | Bundling, Exclusionary Practices | Monopolization of telecommunications |

| Market Dominance | Search, Mobile, Advertising | Operating Systems | Telecommunications |

| Potential Remedies | Divestiture, Restrictions on certain practices | Divestiture, Restrictions on practices | Divestiture |

This table provides a basic comparison. A detailed comparison would require a more in-depth analysis of specific allegations, evidence, and legal arguments in each case. The complexities of the digital economy and the evolving nature of competition make such a direct comparison challenging.

Alternatives to the DOJ’s Proposed Remedies

The Department of Justice (DOJ) has proposed significant remedies to curb Google’s alleged anti-competitive practices. However, these remedies are not without potential drawbacks and alternative approaches exist. Exploring these alternatives is crucial for a balanced evaluation of the situation, considering the multifaceted impact on innovation, market structure, and consumer choice.Alternative approaches to addressing Google’s market power could include various regulatory and market-based interventions.

These approaches often aim to achieve similar goals as the DOJ’s proposals, but through different mechanisms. A nuanced analysis is required to evaluate their potential efficacy and implications.

Potential Alternatives to the DOJ’s Proposed Remedies

Several alternative approaches can be considered to address Google’s market dominance, ranging from regulatory interventions to market-based solutions. These alternatives acknowledge the complexities of the issue and the need for a holistic approach.

- Promoting Competition through Targeted Investment in Emerging Technologies: This approach focuses on fostering innovation in sectors where Google currently holds a dominant position. Funding research and development, and creating incentives for startups in related fields, can lead to more competitive alternatives. For example, funding open-source projects or initiatives in cloud computing or AI could encourage competition to Google Cloud and other AI-related services. This fosters a more competitive ecosystem, but may require substantial public funds and potentially faces challenges in accurately targeting the most impactful investments.

- Strengthening Antitrust Enforcement on Mergers and Acquisitions: A stricter enforcement of existing antitrust laws on mergers and acquisitions involving Google could hinder its expansion and consolidation of power in related markets. This approach could prevent further dominance by actively challenging potential acquisitions that pose a threat to competition. However, this approach may not be sufficient to address existing market power, and its effectiveness depends on the rigor and consistency of enforcement.

- Promoting Interoperability and Open Standards: Encouraging interoperability between Google’s services and those of competitors can lead to a more dynamic and competitive market. This approach aims to reduce the lock-in effect Google’s products often create. For instance, enforcing standards for data exchange between platforms could level the playing field for other companies. However, implementing and enforcing such standards can be complex and may face resistance from companies accustomed to proprietary systems.

- Enhancing Regulatory Scrutiny of Data Practices: A deeper examination of Google’s data collection and usage practices, with stronger regulations, can potentially mitigate the advantages derived from its vast data holdings. This can ensure fair competition and prevent misuse of user data for competitive gain. However, this approach requires significant resources and may face legal challenges regarding data privacy and security concerns.

Comparing DOJ Remedies with Alternative Solutions

The following table compares the DOJ’s proposed remedies with the alternative solutions discussed above.

| Aspect | DOJ’s Proposed Remedies | Alternative Solutions |

|---|---|---|

| Mechanism | Divestiture, restrictions on certain practices | Targeted investment, merger scrutiny, interoperability, data practice regulation |

| Impact on Innovation | Potentially reducing Google’s influence on innovation | Potentially stimulating innovation in competing technologies |

| Impact on Market Structure | Significant restructuring of Google’s business | Gradually shifting market share and power |

| Impact on Consumer Choice | Increased options and competition | Increased options and competition through different mechanisms |

| Implementation Complexity | High, requiring extensive legal and operational changes | Variable, ranging from resource-intensive to relatively less complex |

Future Implications for the Tech Industry

The DOJ’s antitrust case against Google carries significant weight, potentially reshaping the tech landscape. The scrutiny applied to Google’s practices could set a precedent for future regulatory actions, impacting not just Google but other major tech companies. This investigation into Google’s alleged monopolistic practices could signal a broader shift in how regulators approach the digital economy, demanding greater accountability and transparency from industry giants.The implications extend beyond the immediate outcome of the case.

The principles established in the ruling, or the absence of a ruling, could reverberate across various sectors, forcing companies to re-evaluate their business strategies and adapt to a more stringent regulatory environment.

Potential Implications for Other Tech Companies

The DOJ’s investigation into Google’s practices has broad implications for other tech companies, pushing them to review and potentially modify their strategies. Companies with significant market share in digital services, like operating systems, search engines, and cloud computing, may face similar scrutiny. This heightened scrutiny compels a re-evaluation of current business models and operational approaches to avoid future regulatory challenges.

The DOJ’s case against Google’s alleged monopoly practices is a fascinating one, highlighting the complexities of regulating tech giants. One aspect of this is how Google’s dominance impacts user-generated content. For example, the company’s influence on the competitive landscape for contests user generated content contests user generated content could be a crucial element in the overall remedy.

Ultimately, the remedies proposed by the DOJ will shape the future of online competition and user engagement.

Influence on Future Regulatory Actions, Google doj illegal monopoly remedies

The outcome of the Google case will undoubtedly influence future regulatory actions. If the DOJ’s claims are substantiated, future antitrust investigations may target similar practices in other sectors. This could lead to more stringent regulations for companies holding dominant positions in online marketplaces, particularly those with significant data control or network effects. The precedent established could lead to increased regulatory scrutiny of mergers and acquisitions in the tech sector.

Company Adjustments in Response to Potential Precedent

Companies may adjust their practices in several ways to mitigate the risk of similar antitrust challenges. They might reduce their reliance on dominant market positions, foster more open competition through API standards and interoperability, and enhance transparency regarding data collection and use. Examples include implementing independent oversight mechanisms to address potential anti-competitive behavior and ensuring fair treatment of competitors in marketplace dynamics.

Responses from Tech Giants to Future Anti-trust Actions

Tech giants may respond to future antitrust actions with various strategies. They could focus on building more collaborative relationships with competitors, especially in areas like open-source development. Some might seek to influence regulatory discourse through lobbying and public relations efforts, shaping the narrative around their practices. This could involve developing partnerships with smaller companies or actively supporting regulatory frameworks that are seen as beneficial to their interests.

Table: Potential Adjustments in the Tech Industry Landscape

| Aspect | Possible Adjustments |

|---|---|

| Market Share Management | Companies might proactively address concerns regarding their market dominance, perhaps through divesting certain assets or partnerships that enhance market competitiveness. |

| Data Handling Practices | Increased transparency and ethical considerations surrounding data collection and usage are likely to become critical. Companies might implement more robust privacy protections and enhance data security measures. |

| API Standards | Companies might prioritize API standards and interoperability to foster a more open and competitive environment for developers and third-party applications. |

| Competition Fostering | Companies may actively participate in initiatives that promote innovation and competition in their respective industries, possibly through sponsoring open-source projects or providing access to essential resources. |

Impact on Specific Google Services: Google Doj Illegal Monopoly Remedies

The Department of Justice’s (DOJ) antitrust case against Google raises significant questions about the future of Google’s core services, particularly its search engine, advertising platform, and other key offerings. The proposed remedies, if implemented, could reshape the competitive landscape and potentially alter the user experience. This section will analyze the potential impacts on these services, examining implications for consumers and businesses, and projecting possible changes to Google’s business model.The remedies are intended to address concerns about Google’s alleged monopolistic practices.

These actions could force Google to restructure its operations, potentially leading to a decrease in the seamless integration between its various services. This restructuring could lead to a more fragmented user experience.

Search Engine

The DOJ’s concerns regarding Google’s search engine dominance center on the potential for anti-competitive practices. Remedies could require Google to allow third-party search results to be displayed more prominently in its search results pages.This could potentially improve the diversity of search results and allow users to discover alternative sources of information. Conversely, Google might experience a decline in search query volume if users migrate to alternative search engines.

A reduction in the perceived value of Google Search might result in reduced revenue for Google.

Advertising

Google’s advertising business is deeply intertwined with its search engine. Remedies could involve measures to prevent Google from leveraging its search dominance to favor its own advertising products.This could result in a more competitive advertising market, potentially leading to lower advertising costs for businesses and more diverse advertising options for users. However, Google’s advertising revenue could decrease if it loses its prominent position in the advertising ecosystem.

This could lead to job losses and a restructuring of the company’s advertising division.

Other Key Services

Google offers a wide array of services beyond search and advertising, including Android, Maps, and YouTube. The remedies could affect these services in various ways.For example, remedies might mandate that Google allow other apps to be displayed more prominently on the Android operating system, thereby increasing competition in the mobile app market. This could benefit consumers by providing more options and potentially lower prices.

However, this could harm Google’s control over the Android ecosystem, and reduce the overall value proposition of the Android platform.

Consumer Impact

The remedies could lead to a more competitive digital marketplace. Consumers might benefit from increased choice and potentially lower prices.However, there’s also the possibility that some Google services might become less integrated or convenient to use. The long-term effect on user experience remains to be seen.

Business Impact

Businesses that rely on Google’s services for advertising or other purposes might face adjustments. New opportunities may emerge as the competitive landscape shifts.However, some businesses may experience increased costs or difficulties in adapting to the new regulatory environment. The extent of the impact on various business sectors will vary based on their specific dependence on Google’s products and services.

Google’s User Base

Google’s user base is vast and diverse. The remedies could lead to both positive and negative consequences for users.The remedies might lead to a more competitive digital landscape with potentially greater choices. However, Google users might experience changes in the user interface or functionality of certain services. The transition could be disruptive to the user experience.

Likely Changes in Google’s Services After Remedies

| Google Service | Potential Change |

|---|---|

| Search Engine | Increased competition, potentially reduced dominance, altered search results |

| Advertising | More competitive market, potential reduction in revenue, diverse advertising options |

| Other Key Services (e.g., Android, Maps, YouTube) | Increased competition, potential changes in integration and functionality |

Closing Notes

In conclusion, the Google DOJ illegal monopoly remedies case presents a fascinating legal and economic battle with profound implications for the tech industry. This exploration of the history, accusations, potential remedies, and future implications provides a comprehensive overview. The outcome of this case will undoubtedly shape the future of digital competition and consumer choice, making it a significant moment in the evolution of tech regulation.