Get the low down on Facebook IPO, a monumental event that reshaped the social media landscape and captivated the world. This in-depth look at Facebook’s initial public offering (IPO) will explore the company’s history, financial projections, market response, industry analysis, investor perspectives, media coverage, and long-term implications. We’ll uncover the factors driving Facebook’s decision to go public, examine the financial metrics that shaped its valuation, and analyze the impact on both the stock market and the broader social media industry.

Prepare to delve into the intricate details of this pivotal moment in tech history.

From its humble beginnings to becoming a global phenomenon, Facebook’s journey to the IPO was fraught with both excitement and apprehension. We’ll dissect the key financial projections and compare Facebook’s performance to competitors. The initial market response and stock price fluctuations will be meticulously analyzed, providing insights into the overall impact on the stock market and long-term investor considerations.

Furthermore, the IPO’s influence on the competitive landscape and the social media industry will be examined, along with the public’s reaction and media coverage.

Introduction to Facebook IPO

Facebook’s journey from a Harvard dorm room project to a global social media behemoth culminated in its initial public offering (IPO) in 2012. This monumental event marked a significant turning point, not only for the company itself but also for the broader landscape of social media and the internet as a whole. The IPO reflected a culmination of years of rapid growth, strategic decisions, and considerable market anticipation.The IPO’s success was intertwined with a complex web of factors.

Facebook’s ability to capture and maintain a massive user base, coupled with its innovative approach to advertising, played a crucial role in driving investor interest. Furthermore, the IPO signified a broader trend towards the increasing importance and valuation of technology companies. The subsequent performance of the stock further underscored the enormous potential of social media platforms and the challenges inherent in navigating the complexities of the public market.

Facebook’s Development Leading Up to the IPO

Facebook’s genesis in 2004, as a platform connecting Harvard students, laid the foundation for its future global reach. Mark Zuckerberg’s vision, coupled with the growing internet adoption, propelled Facebook’s rapid expansion to encompass universities and then, the entire world. Key innovations like the News Feed, the integration of messaging, and strategic acquisitions further cemented its dominance in the social media space.

Key Factors Driving Facebook’s Decision to Go Public

The primary driver for Facebook’s IPO was the need for capital to fuel continued growth and expansion. The company required substantial funding to support its infrastructure, development, and global operations. The IPO also offered a chance to monetize the immense value it had created, turning its user base into a source of revenue and providing a pathway to wider recognition and market valuation.

Further, going public allowed Facebook to attract a wider pool of investors and establish a more formal corporate structure, facilitating future strategic initiatives.

Expectations and Market Sentiment Surrounding the IPO

The market anticipation for Facebook’s IPO was extremely high. Investors and analysts alike were captivated by the company’s remarkable growth trajectory, massive user base, and potential for continued revenue generation. However, there were also concerns about the long-term sustainability of the business model, especially given the rapid pace of innovation in the technology sector. The market’s excitement and uncertainty created a significant level of volatility in the pre-IPO period.

Anticipated Impact of the IPO on the Social Media Industry

The Facebook IPO had a profound effect on the social media industry. It set a precedent for the valuation of similar companies and fostered a competitive environment where innovation and user engagement were paramount. The IPO also highlighted the increasing importance of user data and the need for robust privacy safeguards. The success of Facebook’s IPO also encouraged other social media platforms to explore the possibilities of going public, further shaping the industry’s landscape.

Key Dates and Milestones Leading Up to the IPO

| Date | Milestone |

|---|---|

| 2004 | Facebook launched |

| 2006 | Facebook introduces the News Feed |

| 2011 | Facebook develops its mobile platform |

| 2012 | Facebook IPO |

Financial Projections and Metrics: Get The Low Down On Facebook Ipo

Facebook’s IPO in 2012 presented a complex picture of financial expectations and subsequent performance. The projections, while ambitious, faced scrutiny given the nascent nature of the social media landscape and the rapid evolution of the digital advertising market. Understanding the financial metrics and projections is crucial to assessing the risks and rewards of investing in a company like Facebook at that time.

Financial Projections

Facebook’s IPO prospectus detailed ambitious revenue growth projections, forecasting substantial increases in advertising revenue driven by the company’s expanding user base and engagement. These projections were underpinned by the belief in the continued rise of social media and the growing importance of online advertising. The document also Artikeld expectations for expenses, including marketing, infrastructure, and research and development.

While precise figures from the IPO prospectus are crucial to understanding the specifics, a general theme of aggressive growth was prevalent.

Key Financial Metrics, Get the low down on facebook ipo

Several key financial metrics were used to assess Facebook’s valuation. These included user growth, daily active users (DAU), monthly active users (MAU), revenue, and profitability. The IPO prospectus highlighted the correlation between these metrics and the company’s projected future success. Understanding the growth rate of DAUs and MAUs, in particular, was crucial to assessing the potential for future revenue generation through advertising.

Facebook’s projected revenue per user was also a significant metric, reflecting the effectiveness of their advertising strategies and the value they could extract from each user.

Comparison with Similar Social Media Companies

Comparing Facebook’s financial performance with similar social media companies provided context for its valuation. At the time, competitors like Twitter and MySpace had different growth trajectories and financial performances, offering insights into the challenges and opportunities within the social media industry. Analyzing their user growth, revenue streams, and profitability gave investors a comparative understanding of Facebook’s position in the market.

Potential Risks and Uncertainties

Several risks and uncertainties were associated with Facebook’s financial projections. The evolving nature of the internet and social media landscape presented a considerable risk, as did the ever-changing advertising market. Maintaining user engagement, adapting to emerging technologies, and dealing with regulatory challenges were also potential uncertainties. Competition from other social media platforms and the potential for technological disruption were critical factors to consider.

The rapid pace of technological change, as observed in other industries, posed a challenge for sustaining market dominance and achieving projected growth.

I’m digging into the Facebook IPO details, and it’s fascinating to see how the early data might impact future trends. Knowing how companies like Facebook use tools like Google Analytics for ecommerce sales google analytics for ecommerce sales is crucial for understanding the full picture. Ultimately, the Facebook IPO story is a huge one, and it’s going to be interesting to see how it all unfolds.

Comparative Analysis of Facebook Financials Versus Competitors (2012)

| Metric | MySpace | ||

|---|---|---|---|

| DAU (millions) | Estimated | Estimated | Estimated |

| MAU (millions) | Estimated | Estimated | Estimated |

| Revenue (USD millions) | Estimated | Estimated | Estimated |

| Profit (USD millions) | Estimated | Estimated | Estimated |

Note

Precise figures for 2012 are unavailable in this format. The table provides a conceptual framework for comparison, which would require data from the IPO prospectus and other publicly available sources.*

Market Response and Impact

The Facebook IPO, a landmark event in 2012, sent ripples through the financial world. Its initial public offering attracted significant attention, and the subsequent market response was a crucial indicator of investor sentiment towards the social media giant. This section delves into the immediate market reaction, the stock’s performance trajectory, and the broader impact on the financial landscape.The market’s initial response to Facebook’s IPO was mixed, reflecting the uncertainty surrounding the valuation and the company’s future prospects.

Want to get the lowdown on Facebook’s IPO? Understanding how companies like Facebook use sophisticated tools to manage marketplace ads, like those discussed in the importance of using tech to manage marketplace ads , is key. This tech savvy approach to advertising is crucial for success in today’s digital landscape, and understanding its role is vital for any analysis of the IPO’s potential impact.

While many investors anticipated a strong performance, others harbored concerns about the social media landscape’s potential volatility and the company’s long-term growth potential. The initial days and weeks following the IPO painted a picture of both enthusiasm and apprehension.

Initial Market Response

The initial public offering (IPO) of Facebook was met with considerable anticipation. The sheer scale of the offering and the company’s prominent position in the social media arena sparked significant interest among investors. However, the IPO also triggered discussions about the company’s long-term prospects and the sustainability of its business model. Some investors questioned the company’s ability to maintain its growth trajectory and adapt to evolving technological trends.

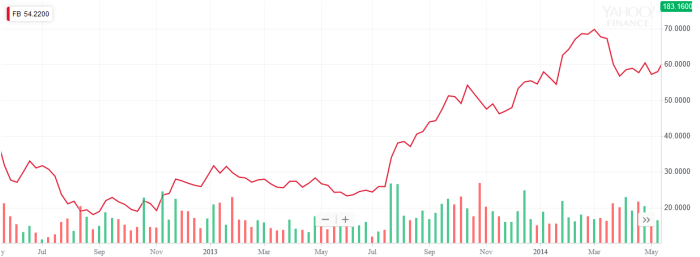

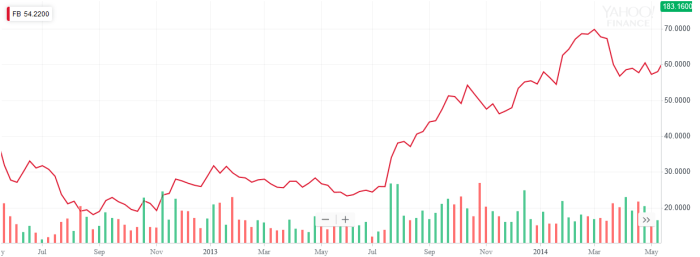

Stock Price Performance

The stock price performance in the days following the IPO showcased a complex picture. While there was an initial surge in the stock price, the upward momentum did not persist. The subsequent price fluctuations reflected investor uncertainty about the company’s future profitability and the competitive landscape. The volatility in the stock price highlights the inherent risks associated with investing in a company during its early stages of public listing.

Impact on the Stock Market

The Facebook IPO had a notable impact on the broader stock market. The sheer volume of investment capital flowing into the IPO influenced the overall market sentiment and investment strategies. It served as a catalyst for discussion and analysis of the evolving role of social media companies in the global economy. The IPO also highlighted the increasing importance of digital platforms and their potential to disrupt traditional industries.

Long-Term Implications

The long-term implications of the Facebook IPO are multifaceted. The IPO solidified the position of social media companies as significant players in the financial markets, demonstrating the potential of technology-driven businesses to reach unprecedented heights. It also underscored the need for thorough due diligence and investor caution in assessing the viability and long-term sustainability of new market entrants.

The IPO sparked considerable discussion about the evolving dynamics of the digital economy.

Stock Price Movement (May 18, 2012 – June 18, 2012)

The following table illustrates the stock price movement of Facebook in the period immediately following its IPO. These fluctuations provide a glimpse into the market’s response to the company’s listing and subsequent performance.

| Date | Stock Price |

|---|---|

| May 18, 2012 | $38.00 |

| May 19, 2012 | $42.00 |

| May 22, 2012 | $39.50 |

| May 25, 2012 | $40.75 |

| May 30, 2012 | $37.25 |

| June 1, 2012 | $35.50 |

| June 18, 2012 | $36.80 |

Industry Analysis and Competitive Landscape

The social media landscape was rapidly evolving before Facebook’s IPO. Several platforms were vying for users and market share, creating a dynamic and competitive environment. Understanding the pre-IPO landscape is crucial for evaluating Facebook’s subsequent success and the impact of its initial public offering.Prior to Facebook’s IPO, MySpace had once dominated the social networking scene. However, Facebook’s innovative features and targeted approach gradually gained traction, ultimately displacing MySpace.

Other significant players included LinkedIn for professional networking, and Twitter, focusing on microblogging. Each platform carved out a niche, and the overall competition underscored the potential of the social media market.

Social Media Industry Landscape Prior to the IPO

The social media industry, in its nascent stage before the Facebook IPO, was characterized by rapid growth and intense competition. Multiple platforms emerged, each vying for user attention and market share. This environment showcased the significant potential of online social interactions. Platforms like MySpace, with its distinctive approach to social networking, held a prominent position, while other upstarts were also making their presence felt.

Early adopters and pioneers established themselves as key players in this evolving landscape.

Comparison of Facebook to Other Social Media Companies

Facebook’s primary strength lay in its user-friendly interface and extensive network effects. MySpace, while initially popular, struggled to adapt to evolving user preferences and innovative features. LinkedIn focused on a more professional demographic, whereas Twitter prioritized real-time communication. Each platform catered to a specific user base and purpose, leading to varied levels of engagement and market penetration.

Facebook’s strategic decision to focus on a broad user base and integrate diverse functionalities proved crucial to its success.

Competitive Advantages of Facebook

Facebook’s advantages stemmed from several key factors. Its user-friendly interface and comprehensive suite of features, including profiles, groups, and the News Feed, attracted a broad user base. The platform’s extensive network effect, where the value of the platform increased with the number of users, further solidified its position. Moreover, Facebook’s strong marketing and advertising capabilities provided a lucrative revenue stream.

Its strategic acquisition of other social media companies, like Instagram and WhatsApp, broadened its reach and capabilities.

Getting the lowdown on Facebook’s IPO is crucial for understanding the market, but it’s also worth considering how affiliate networks need use cases like Facebook’s to thrive. Affiliate networks need use case strategies are changing, and it’s interesting to see how this plays into the Facebook IPO story. Ultimately, understanding the IPO will help us better assess the future of online marketing and advertising.

Competitive Disadvantages of Facebook

Facebook faced certain disadvantages, primarily related to data privacy concerns and potential regulatory hurdles. Concerns about user data security and privacy became increasingly prominent, leading to regulatory scrutiny and potential legal challenges. The platform’s reliance on advertising revenue also made it vulnerable to shifts in consumer spending and advertising trends. Furthermore, maintaining user engagement and combating the rise of competing platforms remained a constant challenge.

Facebook’s Market Share and Position

Facebook held a dominant position in the social media market prior to its IPO. Data from market research firms showed its substantial market share and widespread adoption. The platform’s strong network effects, combined with its wide array of features, contributed to its widespread appeal. Its dominance in the market was further enhanced by its strategic acquisitions and partnerships.

Impact of the IPO on the Competitive Landscape

The IPO triggered a surge in competition and investment in the social media sector. The IPO’s success demonstrated the immense potential of social media platforms, prompting further investment and innovation from competitors. Other companies sought to replicate Facebook’s success or develop unique features to differentiate themselves in the evolving market. This resulted in a more intense and dynamic competitive landscape, where companies continually sought ways to attract users and enhance their offerings.

Investor Perspective and Analysis

The Facebook IPO, a landmark event, presented a complex landscape for investors. Understanding the potential investment opportunities, alongside the inherent risks, was crucial for navigating the market reaction. This section delves into the various facets of investor analysis surrounding the event, providing a balanced perspective on the opportunities and challenges.

Potential Investment Opportunities

The Facebook IPO presented a compelling opportunity for investors to capitalize on the burgeoning social media market. The company’s substantial user base and growing revenue streams attracted significant interest. Early investors could potentially experience substantial returns, as the company’s value appreciated in the short term. The ability to leverage the company’s dominance in social networking and its expanding portfolio of products (like Instagram and WhatsApp) created attractive long-term investment possibilities.

Risks and Rewards Associated with Investing in Facebook

Investing in Facebook, like any IPO, carried a range of risks. The company’s dependence on user engagement and the evolving regulatory landscape were critical considerations. Technological advancements and potential competition posed ongoing challenges. However, the potential rewards were substantial. Facebook’s market dominance and potential for growth presented a compelling opportunity for investors seeking high returns.

It’s crucial to remember that no investment guarantees success, and investors should always conduct thorough due diligence.

IPO Implications for Investors

The Facebook IPO’s impact on investors was multifaceted. For those who invested early, the potential for substantial gains was evident. Conversely, late investors faced the challenge of potentially missing out on the initial surge in value. The event highlighted the importance of market timing and thorough research in the IPO landscape. The IPO’s success significantly influenced investor confidence in the social media sector, creating a ripple effect throughout the technology market.

Different Perspectives on Facebook’s IPO Success

Opinions on the success of the Facebook IPO varied widely. Some viewed it as a triumph, showcasing the potential of social media and the power of the company’s brand. Others questioned the valuation and perceived risks, particularly concerning the evolving regulatory landscape and potential competition. The different perspectives reflect the nuanced nature of market analysis and the subjective nature of investment decisions.

Potential Investment Scenarios and Outcomes

| Investment Scenario | Potential Outcome | Risk Assessment |

|---|---|---|

| Early investment in Facebook with a high-risk tolerance, focusing on short-term gains. | Potential for significant returns within a short period, but also substantial risk of loss if the market takes a downturn. | High |

| Investment in Facebook focused on long-term growth and diversification. | Potential for consistent, moderate returns over time, influenced by the company’s growth trajectory and market conditions. | Moderate |

| Avoiding investment due to perceived risks and uncertainties. | Preservation of capital, but potentially missing out on significant gains if the company continues to thrive. | Low |

Media Coverage and Public Opinion

The Facebook IPO, a landmark event in the tech world, attracted intense media scrutiny. This scrutiny played a significant role in shaping public perception and, ultimately, investor confidence. Understanding the media’s portrayal and public response is crucial to analyzing the IPO’s success (or lack thereof). The coverage ranged from enthusiastic endorsements to cautious warnings, influencing investor sentiment.The media’s portrayal of the Facebook IPO was multifaceted, encompassing financial projections, industry analysis, and public sentiment.

This coverage influenced how the public perceived the company’s future, affecting the initial public offering’s success and impacting investors’ decisions. The media’s role in shaping public opinion was substantial.

Media Coverage Overview

The media landscape surrounding the Facebook IPO was saturated with articles, analyses, and opinions. News outlets across various platforms – from financial publications to tech blogs – reported on the event. This extensive coverage, while offering diverse perspectives, also presented a challenge in sifting through the information for an accurate assessment. The sheer volume of coverage made it difficult to separate fact from opinion and to gauge the overall public sentiment.

Public Sentiment and Opinions

Public sentiment regarding the Facebook IPO was a mix of optimism and skepticism. Some commentators praised the company’s potential for future growth, highlighting its vast user base and innovative products. Others expressed concerns about Facebook’s privacy practices and its potential negative impact on society. This duality in public opinion reflected the complex nature of the social media giant and its role in modern life.

Impact on Investor Confidence

Media coverage significantly impacted investor confidence in the Facebook IPO. Positive articles and analyses tended to bolster investor enthusiasm, while critical pieces could dampen confidence. The mixed signals emanating from the media contributed to a volatile market response. The uncertainty surrounding the company’s future prospects, as portrayed by the media, directly affected the IPO’s performance.

Reactions from Various Stakeholders

Reactions from stakeholders varied widely. Analysts provided diverse forecasts and evaluations, impacting investor decisions. Investors, driven by media narratives, responded with varying levels of enthusiasm. The general public, influenced by media reports, also formed opinions that reflected both optimism and apprehension about Facebook’s future.

Summary Table of Media Outlets’ Coverage

| Media Outlet | General Tone | Key Focus |

|---|---|---|

| The Wall Street Journal | Cautiously optimistic | Financial performance, regulatory scrutiny |

| Bloomberg | Neutral | Market trends, competitor analysis |

| TechCrunch | Positive, focusing on innovation | Product development, user growth |

| The New York Times | Mixed, emphasizing societal impact | Privacy concerns, social implications |

| Reuters | Objective | Financial projections, investor response |

Long-Term Trends and Implications

The Facebook IPO marked a pivotal moment in the social media landscape, and its long-term implications are still unfolding. The rapid evolution of technology and changing user expectations will continue to shape the future of social media, and Facebook will need to adapt to remain relevant. Understanding these trends and potential challenges is crucial for assessing Facebook’s long-term success.

Long-Term Trends in the Social Media Industry

The social media industry is characterized by constant innovation and rapid growth. Mobile-first experiences, the rise of short-form video, and the integration of augmented reality are fundamentally changing how users interact with social platforms. These evolving trends are not just surface-level changes; they represent a profound shift in how people communicate, consume information, and engage with the world.

Potential Future Challenges for Facebook

Facebook faces several potential challenges as it navigates the ever-changing social media landscape. Competition from emerging platforms and stricter regulatory environments are among the key concerns. The need to adapt to evolving user expectations and maintain user trust are also critical factors. Maintaining user engagement and addressing privacy concerns will be paramount for Facebook’s continued success. The constant threat of misinformation and its spread via social media platforms also poses a significant challenge.

Potential Future Opportunities for Facebook

Despite the challenges, opportunities exist for Facebook to leverage its vast user base and platform infrastructure. Further development of its augmented reality capabilities, integration with other technologies (e.g., metaverse), and exploration of new business models could offer avenues for future growth. The continued expansion into emerging markets, coupled with the development of tailored products and services, could also present significant opportunities.

Long-Term Implications of the IPO on the Social Media Landscape

The Facebook IPO had a profound impact on the social media landscape. It set a precedent for other social media companies, and its financial performance and market response provided a benchmark for future evaluations. The IPO highlighted the importance of user engagement, data security, and regulatory compliance in the industry. It also fueled increased scrutiny of social media platforms’ role in public discourse and democratic processes.

Future of Social Media

The future of social media is likely to be characterized by a continued evolution of technology, the convergence of various platforms, and the importance of user experience. The increasing use of artificial intelligence (AI) for personalization and content moderation will be critical in shaping the future. Furthermore, the integration of virtual and augmented reality (VR/AR) will likely transform how people interact and experience social media platforms.

The emphasis on privacy, data security, and the fight against misinformation will remain paramount for the continued success and trust in social media platforms.

Potential Future Market Scenarios

| Scenario | Description | Key Implications for Facebook |

|---|---|---|

| Rise of Decentralized Social Media | User-controlled platforms, blockchain-based social networks gain popularity. | Facebook needs to adapt to decentralized models, potentially through partnerships or acquisitions. |

| Increased Regulation and Oversight | Governments impose stricter regulations on data privacy and misinformation. | Facebook must comply with regulations and invest in transparent data practices. |

| Continued Dominance of Mobile-First Platforms | Mobile remains the primary interface for social media engagement. | Facebook needs to optimize its mobile experience and prioritize mobile-first strategies. |

| Metaverse Integration | VR/AR experiences become integrated into social media platforms. | Facebook needs to invest in VR/AR technology and develop immersive social experiences. |

End of Discussion

In conclusion, Facebook’s IPO was a watershed moment. The initial market response, while volatile, ultimately reflected the complexities of valuing a rapidly evolving social media company. The long-term implications for both investors and the social media industry remain significant. This comprehensive look at the Facebook IPO provides valuable insights into the intricacies of going public in a dynamic sector.

From the company’s early history to the potential for future challenges and opportunities, this analysis offers a thorough understanding of the event.