Profitability the final piece in the VCP process is crucial for any successful value creation strategy. It’s not just about generating revenue; it’s about understanding how various factors influence profitability at each stage of the VCP. From defining profitability metrics to identifying challenges and crafting effective strategies, this exploration delves into the intricate relationship between value creation and achieving desired profit margins.

We’ll examine how internal and external elements affect profitability and how a well-defined customer value proposition can optimize results.

This discussion will Artikel the key metrics, drivers, and challenges associated with profitability within the Value Creation Process (VCP). We’ll also look at strategies to enhance profitability, ensuring alignment between value creation and profit targets, and the impact of customer value propositions on the overall outcome. Illustrative examples and a table summarizing key insights will help solidify these concepts.

Defining Profitability in the VCP Process: Profitability The Final Piece In The Vcp Process

Profitability in the Value Creation Process (VCP) isn’t just about making a profit; it’s about achieving a sustainable and measurable return on investment throughout the entire process. It’s crucial to understand how profitability is defined and measured at each stage of the VCP to ensure alignment with overall business objectives and drive continuous improvement. This involves careful analysis of various factors that influence profitability and using appropriate metrics to track progress and identify potential areas for optimization.Understanding profitability in the VCP requires a holistic perspective, encompassing not only financial gains but also the broader value created for the organization and its stakeholders.

Profitability is often the final piece in the VCP process, but how do you keep track of all those important documents? Efficient document management is key, and using WordPress for this can streamline your workflow significantly. Check out this helpful guide on how to use WordPress for document management or file management to learn how to organize and access files easily.

Ultimately, a well-structured system contributes directly to your bottom line, making profitability a much smoother and more predictable outcome in your VCP process.

This includes evaluating the effectiveness of resources used, the efficiency of processes, and the overall contribution to the strategic goals. This detailed understanding allows for informed decision-making, ensuring that resources are allocated effectively and that the VCP remains a driving force for success.

Profitability Metrics in Different VCP Stages

Different stages of the VCP require different profitability metrics. These metrics are essential for tracking progress, identifying bottlenecks, and ensuring that the process as a whole contributes to the company’s financial goals. A consistent and standardized approach to measurement is vital for accurate analysis and actionable insights.

- Ideation and Planning Stage: Profitability in this initial phase is less about direct financial gain and more about the potential return on investment. Key metrics here include the projected ROI, feasibility studies’ results, and the cost-benefit analysis of potential projects or initiatives.

- Implementation Stage: This stage focuses on managing costs and maximizing efficiency to achieve the projected ROI. Key profitability metrics include cost per unit, production yield, and the actual cost-benefit ratio. A detailed comparison of the actual costs versus the planned costs is crucial.

- Growth and Optimization Stage: As the VCP matures, profitability analysis shifts towards maximizing revenue and minimizing costs. Key metrics here are revenue per customer, customer lifetime value, and the return on marketing investment. Evaluating customer acquisition costs and their impact on profitability is important.

- Sustainability Stage: In this stage, profitability is viewed through a long-term lens. Key metrics include long-term profitability forecasts, the sustainability of the VCP’s impact on the business, and the potential for future revenue streams.

Factors Influencing Profitability in the VCP

Profitability in the VCP is influenced by a variety of factors, ranging from market conditions to internal operational efficiency. A comprehensive understanding of these factors is crucial for optimizing profitability and ensuring the VCP aligns with the overall strategic direction of the organization.

- Market Conditions: External factors like market demand, competitor activity, and economic trends significantly impact profitability. Fluctuations in market demand, pricing strategies of competitors, and macroeconomic conditions can have a major effect.

- Resource Allocation: The efficient allocation of resources (financial, human, and technological) is essential for profitability. The right amount of resources dedicated to each VCP stage is vital for optimized results.

- Operational Efficiency: Minimizing waste and maximizing productivity across the different VCP stages is paramount for profitability. Optimizing processes, streamlining workflows, and reducing operational costs all contribute significantly to overall profitability.

- Customer Value Proposition: A well-defined and compelling value proposition is critical for attracting and retaining customers. The ability to offer value that meets customer needs and expectations has a direct impact on profitability.

Profitability Metrics Across VCP Stages

This table illustrates the different stages of the VCP and their corresponding profitability metrics:

| VCP Stage | Key Profitability Metrics |

|---|---|

| Ideation & Planning | Projected ROI, Feasibility Study Results, Cost-Benefit Analysis |

| Implementation | Cost per Unit, Production Yield, Actual Cost-Benefit Ratio |

| Growth & Optimization | Revenue per Customer, Customer Lifetime Value, Return on Marketing Investment |

| Sustainability | Long-term Profitability Forecasts, Sustainability Impact, Future Revenue Streams |

Profitability Drivers in VCP

Unlocking profitability in the Value Creation Process (VCP) hinges on understanding and strategically leveraging key drivers. This involves more than just revenue; it necessitates a comprehensive approach that considers internal capabilities, external market forces, and the effective deployment of resources. A strong VCP framework emphasizes these interconnected factors, ensuring long-term sustainable growth and profitability.Profitability in the VCP is not a singular outcome, but rather a multifaceted result stemming from various intertwined factors.

A well-structured VCP analysis must examine the interplay of internal resource management, external market dynamics, and the adaptability of strategies. This approach allows for the identification of strengths, weaknesses, and areas requiring improvement, ultimately leading to a more robust and profitable value creation process.

Primary Profitability Drivers

The primary drivers of profitability within the VCP encompass several key areas. These include, but are not limited to, optimized resource allocation, effective value proposition design, and robust market positioning. A meticulous analysis of these elements is crucial for achieving sustainable profitability within the VCP framework.

- Optimized Resource Allocation: Efficient utilization of resources, both human and capital, is paramount. This involves careful planning, forecasting, and the allocation of resources to their most productive use. Examples include streamlining workflows, minimizing waste, and investing in training and development for employees.

- Effective Value Proposition Design: A well-defined and compelling value proposition resonates with target customers, highlighting unique benefits and addressing their specific needs. This involves thorough market research, competitor analysis, and the creation of a value proposition that truly differentiates the organization.

- Robust Market Positioning: A strong market position enables the company to command premium pricing and maintain a competitive edge. This is achieved through effective branding, targeted marketing campaigns, and a deep understanding of customer preferences.

Impact of Different Strategies on Profitability

Various strategies influence profitability in different ways. Some strategies, such as cost leadership, focus on minimizing costs while maintaining acceptable quality. Others, such as differentiation, emphasize unique features and benefits to command premium pricing.

- Cost Leadership Strategies: These strategies often prioritize efficiency and economies of scale to achieve lower costs. This can lead to higher profitability by increasing profit margins, especially in competitive markets where price sensitivity is high.

- Differentiation Strategies: These strategies focus on creating unique products or services that are valued by customers. This can result in higher prices and premium margins. However, the costs of developing and maintaining these differentiators need careful consideration.

- Focus Strategies: These strategies concentrate on serving a specific niche market or segment. The profitability of focus strategies depends on the attractiveness of the target market and the company’s ability to cater to its specific needs.

Influence of Internal and External Factors

Profitability is influenced by both internal and external factors. Internal factors relate to the company’s operations and resource management, while external factors encompass market trends, economic conditions, and competitive pressures.

- Internal Factors: These factors include the efficiency of internal processes, the quality of resources, and the effectiveness of employee training. Improved employee training, for instance, can boost productivity and efficiency, leading to greater profitability.

- External Factors: External factors, such as economic downturns, changes in consumer preferences, or regulatory changes, can significantly impact profitability. A company’s adaptability to these external shifts is crucial for maintaining its profitability.

Role of Resources and Capabilities

Resources and capabilities play a vital role in achieving profitability within the VCP. Resources encompass tangible assets like technology and facilities, while capabilities are intangible assets such as expertise and organizational processes. The effective utilization of these resources and capabilities is crucial for success.

| Resource | Capability | Impact on Profitability |

|---|---|---|

| Advanced Technology | Innovation | Enhanced product offerings, reduced costs, higher revenue |

| Strong Brand Recognition | Customer Relationship Management | Premium pricing, increased customer loyalty |

| Skilled Workforce | Process Optimization | Improved efficiency, reduced production costs, higher quality |

Profitability Challenges in VCP

Profitability within the Value Creation Process (VCP) is crucial for long-term success. While the drivers of profitability have been explored, understanding the potential roadblocks is equally vital. Navigating these challenges effectively can significantly impact the overall success of the VCP.Identifying and addressing profitability challenges proactively is paramount to maximizing returns and achieving sustainable growth. By understanding the potential hurdles at each stage of the VCP, organizations can implement strategies to mitigate risks and capitalize on opportunities.

This involves recognizing common pitfalls and implementing corrective actions.

Potential Challenges During Different VCP Stages

The VCP encompasses various stages, each presenting unique profitability challenges. Understanding these challenges during different stages allows for targeted interventions.

- Ideation and Planning: Insufficient market research or flawed assumptions about customer needs can lead to a product or service that doesn’t resonate with the target market, thus hindering profitability. Poorly defined value propositions or unrealistic pricing strategies can also significantly impact profitability in the early stages. A thorough market analysis and customer validation are crucial to avoid costly mistakes.

- Development and Testing: Unforeseen technical difficulties during development or inadequate testing can delay project completion and increase costs, impacting profitability. Poorly designed workflows or inadequate resource allocation can lead to bottlenecks and inefficiencies, affecting the project’s bottom line. Investing in robust development processes, including rigorous testing procedures, and effective resource management, is essential to mitigate these risks.

- Deployment and Implementation: Smooth deployment is crucial to avoid disruptions in operations and customer service. Resistance to change or inadequate training for staff can negatively affect the adoption rate of new solutions. Comprehensive deployment strategies and effective change management are key to success. Insufficient or poorly planned rollout strategies can lead to customer dissatisfaction and decreased revenue.

- Monitoring and Optimization: Failure to monitor key performance indicators (KPIs) or a lack of data analysis can hinder the ability to identify and address performance issues in a timely manner. Inflexibility in adapting to changing market conditions or customer preferences can lead to stagnation and declining profitability. Regular performance monitoring, data analysis, and agility in response to market changes are critical for sustained profitability.

Common Pitfalls and Mistakes

Certain mistakes are frequently repeated, significantly hindering profitability within the VCP. Recognizing these pitfalls is essential for proactive problem-solving.

- Underestimating Project Costs: Often, teams underestimate the total costs associated with a project, including development, testing, deployment, and ongoing maintenance. This can lead to significant financial losses.

- Ignoring Customer Feedback: Neglecting customer feedback throughout the VCP lifecycle can result in a product or service that fails to meet customer needs, ultimately impacting profitability. Actively seeking and incorporating feedback is crucial.

- Poor Time Management: Poorly planned timelines and unrealistic deadlines can lead to delays, increased costs, and reduced profitability. Developing realistic project schedules and managing time effectively are essential.

- Inadequate Risk Management: Ignoring potential risks and challenges can lead to unexpected setbacks and financial losses. Proactive risk assessment and mitigation strategies are critical.

Addressing Profitability Challenges: A Strategic Approach

A structured approach to addressing profitability challenges is essential. This involves identifying the root causes of issues and implementing targeted solutions.

| Challenge | Root Cause | Potential Solutions |

|---|---|---|

| Insufficient Market Research | Lack of customer understanding | Thorough market research, customer surveys, competitor analysis |

| Unrealistic Pricing | Poor cost estimation | Detailed cost analysis, value-based pricing strategies |

| Technical Difficulties | Inadequate development process | Robust development processes, iterative development, testing |

| Resistance to Change | Poor communication or training | Effective change management strategies, clear communication, comprehensive training |

| Poor Time Management | Lack of project planning | Detailed project planning, realistic timelines, resource allocation |

Strategies for Enhancing Profitability in VCP

Unlocking the full potential of your Value Creation Process (VCP) hinges on optimizing profitability at every stage. This involves a multifaceted approach, from strategic resource allocation to meticulous cost management. Understanding the specific drivers and challenges within your VCP is crucial to developing effective strategies for sustained profitability.Profitability enhancement in VCP isn’t a one-size-fits-all solution. It requires tailoring strategies to the unique characteristics of your organization and the specific stages of the VCP.

By analyzing each phase – from initial ideation to final delivery – we can identify key leverage points for improving profitability.

Strategies at Different VCP Stages

Effective profitability strategies must be integrated across the entire VCP lifecycle. This requires a holistic understanding of each stage’s unique contribution to the overall profitability. Strategies at each stage should focus on optimizing resource allocation, minimizing costs, and maximizing revenue generation.

Strategies for Enhancing Profitability in the Ideation Stage

Thorough market research and competitive analysis are crucial for ideation stage profitability. This involves identifying market gaps, understanding customer needs, and assessing the potential for a successful product or service. Early stage validation is critical, reducing the risk of investing in unviable ideas. This could involve conducting surveys, testing prototypes, or engaging in early user feedback sessions.

By understanding the market, companies can align their VCP outputs with market demands, minimizing the chance of developing products that don’t find a market.

Profitability is often the final piece in a successful VCP process, and understanding your target audience is key. Knowing your website visitors’ demographics, like those revealed by LinkedIn’s new tool LinkedIn’s new tool website demographics , can help fine-tune your strategy to maximize profitability. Ultimately, understanding your customer better leads to a more profitable VCP.

Strategies for Enhancing Profitability in the Development Stage

Efficient resource allocation and cost control are paramount during the development phase. Accurate budgeting, realistic timelines, and effective project management are essential. The use of agile methodologies can be a powerful tool for adaptation to changing requirements and for ensuring that development resources are utilized efficiently. For instance, incorporating iterative development allows for continuous feedback and adjustments, reducing the likelihood of costly errors later in the process.

Strategies for Enhancing Profitability in the Delivery Stage

Focus on optimizing the delivery process for improved efficiency and reduced costs. This includes streamlining workflows, implementing automation tools, and leveraging technology to reduce manual processes. Streamlining the delivery process and ensuring customer satisfaction are critical. Excellent customer service and timely delivery can significantly impact profitability.

Comparison of Profitability Enhancement Approaches

Different approaches to enhancing profitability in VCP can be compared based on their potential impact, resources required, and associated risks. For example, process automation can significantly reduce operational costs but may require substantial upfront investment. Conversely, focusing on customer relationship management (CRM) might yield long-term benefits but demand sustained effort in building and maintaining strong customer relationships. Careful analysis of each approach is essential for selecting the most effective strategy for a particular VCP.

Table of Profitability Enhancement Strategies

| Strategy | Expected Outcomes | Potential Risks |

|---|---|---|

| Process Automation | Reduced operational costs, increased efficiency, improved accuracy | High upfront investment, potential job displacement, reliance on technology |

| Customer Relationship Management (CRM) | Improved customer retention, increased sales, enhanced customer lifetime value | Requires ongoing effort, potential for data security breaches, complexity of implementation |

| Value Stream Mapping | Identification of waste and inefficiencies, improved workflow, cost reduction | Requires specialized knowledge, potentially disruptive to existing processes, may require significant training |

| Pricing Strategy Optimization | Increased revenue, improved profitability margins, targeted pricing | Potential for customer backlash, need for accurate market research, possible competitive responses |

Profitability and Value Creation Alignment

Profitability is the ultimate goal of any venture capital (VC) process. However, simply chasing short-term profits can often hinder long-term value creation. A successful VC process must understand and leverage the interconnectedness of profitability and value creation. A well-structured approach recognizes that maximizing value creation often leads to a more sustainable and higher level of profitability over time.Value creation and profitability are not mutually exclusive; they are intertwined aspects of a successful venture capital process.

A strong focus on value creation, encompassing strategic investments, effective management support, and market expansion, can ultimately lead to a higher level of profitability. This alignment is crucial for long-term success and enduring returns.

Relationship Between Profitability and Value Creation

The relationship between profitability and value creation in the VCP is a direct correlation. Value creation, achieved through innovative solutions, market expansion, and strategic partnerships, often translates to higher revenue and profit margins. In essence, a strong foundation of value creation fuels sustained profitability. This is a fundamental principle in VC strategy, underpinning successful investments and long-term returns.

Maximizing Value Creation for Higher Profitability

Maximizing value creation is a powerful driver of profitability in the VCP. This involves identifying opportunities to enhance product offerings, expand into new markets, and cultivate strong relationships with strategic partners. These initiatives contribute to market leadership, increased market share, and ultimately, higher profitability. For instance, a VC firm that invests in a company developing sustainable energy solutions will likely see greater returns if that company gains significant market share due to its value-creating innovation.

Short-Term vs. Long-Term Profitability Trade-offs

Short-term profitability can sometimes conflict with long-term value creation. While quick returns are tempting, strategies focused solely on immediate profits can neglect crucial aspects of value building, such as research and development, or building strong leadership teams. This approach might yield short-term gains but may compromise the company’s long-term growth potential and future profitability. Finding the right balance is key.

Aligning Value Creation Goals with Profitability Targets

Aligning value creation goals with profitability targets is critical for a successful VCP. This means clearly defining the metrics for both value creation and profitability, and establishing a framework to track and measure progress towards these goals. The alignment process ensures that every investment decision contributes both to the value proposition and the bottom line. For instance, a VC might prioritize investments in companies with strong growth potential and sustainable business models, even if those companies don’t show immediate high profitability.

Impact of Value Creation Initiatives on Profitability

| Value Creation Initiative | Potential Impact on Profitability | Explanation |

|---|---|---|

| Developing innovative products/services | Increased revenue, higher profit margins | Innovation often leads to premium pricing and reduced production costs. |

| Expanding into new markets | Increased market share, wider revenue base | Access to new customer segments can significantly increase revenue. |

| Strengthening brand reputation | Increased brand loyalty, premium pricing | Strong brands can command higher prices and increase customer lifetime value. |

| Building strong leadership teams | Improved operational efficiency, reduced costs | Effective leadership translates to efficient resource allocation and higher productivity. |

| Strategic partnerships | Access to new resources, expanded market reach | Collaborations with complementary businesses can open up new opportunities and markets. |

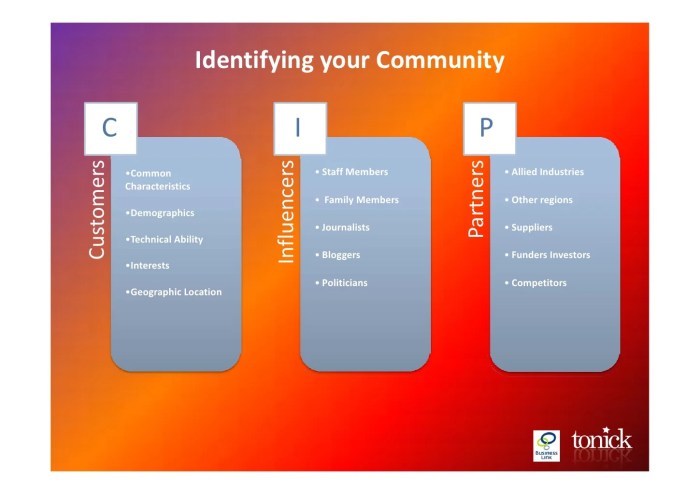

Profitability and Customer Value Proposition

The customer value proposition (CVP) is the cornerstone of any successful business. It’s not just about selling a product or service; it’s about understanding and delivering value that resonates with a specific customer segment. A strong CVP directly influences profitability, impacting everything from pricing strategies to resource allocation. This crucial link between customer value and financial success is the focus of this exploration.A well-defined CVP allows businesses to tailor their offerings to meet specific customer needs, leading to higher customer satisfaction and ultimately, greater profitability.

This involves careful consideration of various customer segments and their unique requirements, enabling businesses to optimize their value proposition for maximum impact.

How the Customer Value Proposition Influences Profitability

The customer value proposition directly impacts profitability through several mechanisms. A compelling CVP attracts and retains customers, leading to increased sales volume and revenue. It also allows for price premiums based on perceived value, rather than simply cost-plus pricing. Furthermore, satisfied customers are more likely to become loyal advocates, generating positive word-of-mouth marketing, reducing customer acquisition costs and fostering repeat business.

Ultimately, a robust CVP can create a virtuous cycle of value creation and profitability.

Different Customer Segments Impact on Profitability

Understanding that customer segments have varying needs and expectations is crucial. Different customer segments may respond differently to the same value proposition. A business needs to identify these segments, analyze their specific requirements, and tailor its value proposition accordingly. For example, a premium customer segment might value exclusivity and customization, while a budget-conscious segment might prioritize affordability.

By recognizing these differences and creating targeted value propositions, a company can effectively capture the full potential of each segment and increase overall profitability.

The Role of Customer Satisfaction in Achieving Profitability

Customer satisfaction is inextricably linked to profitability. High customer satisfaction often translates into repeat business, positive word-of-mouth referrals, and ultimately, increased revenue. Satisfied customers are more likely to remain loyal, reducing the costs associated with acquiring new customers. Furthermore, customer satisfaction can act as a powerful driver of customer lifetime value. By focusing on delivering exceptional customer experiences, businesses can cultivate strong relationships and build a loyal customer base, ensuring long-term profitability.

Adapting the Value Proposition to Optimize Profitability, Profitability the final piece in the vcp process

Businesses must continually adapt their value propositions to reflect changing market conditions and customer needs. Market research and customer feedback are essential tools in this process. By analyzing market trends and gathering customer insights, companies can identify opportunities to enhance their value proposition and optimize profitability. This might involve introducing new features, improving existing offerings, or exploring new customer segments.

Profitability is often the final piece in the VCP process, and securing funding is key. Knowing how to leverage resources like Google for Nonprofits, a great resource for finding out about Google Ad Grants, can really help. This comprehensive guide provides invaluable insights for nonprofits looking to optimize their online presence and increase donations, ultimately contributing to their bottom line and improving the organization’s overall financial health.

Ultimately, profitability is still the crucial final piece to a successful VCP (Volunteer Compensation Plan).

Staying responsive to market dynamics ensures that the value proposition remains relevant and effective.

Example of a Successful Company Linking CVP with Profitability

Apple is a prime example of a company that effectively linked its customer value proposition with profitability. Apple’s CVP centers on innovative products, sleek design, seamless user experiences, and a strong brand identity. This resonates with a specific customer segment that values aesthetics, technology, and user-friendliness. The company’s focus on high-quality products and exceptional customer service has resulted in strong brand loyalty, premium pricing, and impressive profitability figures.

This illustrates the power of a well-defined CVP in driving both customer value and financial success.

Illustrative Examples of Profitability in VCP

Profitability in the Value Creation Process (VCP) isn’t a theoretical concept; it’s a tangible outcome achievable through strategic implementation. Real-world examples highlight how businesses across various sectors leverage VCP to drive profitability, aligning value creation with financial success.

Understanding these examples allows us to analyze the key drivers of profitability within different VCP scenarios and the steps taken by successful companies. This deeper dive provides a practical understanding of how to translate value creation into tangible financial gains.

Real-World Applications of Profitability in Different VCP Scenarios

Successful VCP implementations demonstrate a strong correlation between customer value proposition and profit margins. Companies that effectively identify customer needs and develop products or services addressing those needs typically achieve higher profitability. For instance, a company focusing on customer convenience might offer expedited delivery options, potentially leading to increased sales and profit margins.

- Technology Sector: A software company might offer tiered pricing models, offering basic features at a lower price and premium features at a higher price, thus maximizing revenue streams.

- Retail Sector: A clothing retailer might implement a loyalty program offering exclusive discounts and promotions to retain customers and drive repeat purchases, improving profitability.

- Healthcare Sector: A healthcare provider offering telemedicine services can potentially reduce overhead costs and increase patient access, leading to a more streamlined and profitable operation.

Profitability Achieved in Various Industries

Profitability within different industries is achieved through diverse approaches. Identifying and targeting specific market segments, understanding competitive landscapes, and effectively managing operational costs are crucial factors.

- Financial Services: Banks and financial institutions can achieve profitability through efficient risk management, streamlined processes, and optimized pricing strategies.

- Manufacturing: Manufacturing companies can enhance profitability through automation, optimizing supply chains, and implementing lean manufacturing principles to reduce waste and increase production efficiency.

- Hospitality: Hotels and restaurants achieve profitability through effective customer service, optimal pricing strategies, and efficient management of operational costs.

Steps Taken by Successful Companies to Achieve High Profitability

High profitability isn’t accidental; it’s a result of deliberate strategies. Companies often adopt a multi-faceted approach.

- Strategic Planning: Developing a comprehensive VCP strategy aligned with the company’s overall business objectives.

- Customer Focus: Deep understanding of customer needs, preferences, and expectations to tailor offerings and enhance value proposition.

- Operational Efficiency: Implementing streamlined processes, reducing waste, and optimizing resource allocation.

Case Study: Value Creation and Profitability in the Renewable Energy Sector

The renewable energy sector exemplifies the connection between value creation and profitability. Companies in this sector often create value by offering sustainable solutions to environmental challenges while generating profits. Companies like Tesla, for example, have demonstrated high profitability through the integration of innovative battery technology into various products and services, addressing both environmental and customer needs simultaneously.

Profitability of Different VCP Models for Various Businesses

Different VCP models can lead to different levels of profitability depending on the specific business and industry. The table below illustrates this.

| VCP Model | Business Type | Profitability (Estimated) |

|---|---|---|

| Subscription-Based | Software, SaaS | High |

| Transaction-Based | Retail, E-commerce | Medium to High |

| Value-Added Services | Consulting, Healthcare | High |

| Product-Centric | Manufacturing, Consumer Goods | Medium |

Note: Profitability estimates are general and may vary significantly depending on specific factors.

Final Conclusion

In conclusion, profitability the final piece in the VCP process is not a standalone element but a crucial component integrated throughout the entire value creation journey. By understanding the metrics, drivers, and challenges, and by implementing effective strategies, businesses can optimize profitability and achieve alignment with their overall value creation goals. A well-defined customer value proposition, tailored to specific customer segments, will be critical for achieving the desired outcome.

The examples and analysis provided will empower readers to apply these principles in their own value creation endeavors.