Top 5 marketing initiatives for accounting financial services firms are crucial for success in today’s competitive market. This in-depth look explores defining effective marketing strategies, identifying key target audiences, and evaluating current practices. We’ll delve into designing impactful initiatives, measuring performance, and illustrating effective and ineffective strategies with real-world case studies. Understanding these strategies is essential for firms seeking to attract clients and grow their business.

The article will cover everything from defining the scope of marketing initiatives in accounting and financial services to identifying target audiences and evaluating current practices. We’ll also look at designing top 5 marketing initiatives, measuring and analyzing marketing performance, and illustrating effective and ineffective strategies through case studies. This comprehensive approach provides a clear path to developing a successful marketing strategy for accounting firms.

Defining the Scope of Marketing Initiatives

Marketing initiatives for accounting and financial services firms are crucial for attracting and retaining clients, building brand reputation, and driving revenue growth in a competitive market. They encompass a wide range of activities designed to promote services, generate leads, and establish a strong presence in the industry. These initiatives are distinct from general marketing principles due to the specialized nature of financial services, emphasizing trust, expertise, and long-term client relationships.Effective strategies in this sector must resonate with the specific needs and expectations of clients who value expertise and personalized service.

Unlike consumer-focused marketing, the emphasis is often on demonstrating value proposition, security, and the expertise of the firm and its personnel. This requires tailored messaging, building trust, and showcasing a deep understanding of financial complexities.

Defining Marketing Initiatives for Accounting and Financial Services Firms

Marketing initiatives in accounting and financial services are activities that promote the firm, its services, and its expertise to potential and existing clients. This encompasses a broad range of tactics, including but not limited to: building a strong online presence, developing targeted marketing materials, participating in industry events, establishing strategic partnerships, and cultivating relationships with key stakeholders. A successful marketing initiative often involves a multi-faceted approach, integrating various strategies to achieve specific goals.

So, you’re looking to boost your accounting firm’s marketing? Top 5 initiatives often revolve around digital presence and client acquisition. A crucial aspect is ensuring your website, especially mobile landing pages, loads lightning fast. Optimizing for speed, like using google adwords speed mobile landing pages , is key for a positive user experience and higher conversion rates.

This translates directly into more leads and ultimately, more clients for your financial services firm.

Key Characteristics of Effective Marketing Strategies

Effective marketing strategies in accounting and financial services differentiate themselves from other industries by focusing on building trust, demonstrating expertise, and emphasizing long-term relationships. These strategies are not about quick wins but rather about creating sustainable value for clients over an extended period. This approach emphasizes establishing credibility through professional certifications, testimonials, and transparent communication. A strong brand image is also vital, conveying reliability and competence.

Goals and Objectives of Top 5 Marketing Initiatives

The top 5 marketing initiatives for accounting and financial services firms should aim to achieve specific, measurable, achievable, relevant, and time-bound (SMART) goals. These goals should focus on lead generation, client acquisition, and brand awareness. For instance, an initiative aimed at attracting new clients might involve a specific target number of qualified leads within a set timeframe. Another objective might be to increase brand visibility within a certain geographic area or industry sector.

The key is to establish clear, quantifiable targets that can be tracked and assessed. These goals should be aligned with the firm’s overall strategic objectives and contribute to its long-term success.

Comparison of Marketing Approaches

| Characteristic | Digital Marketing | Traditional Marketing |

|---|---|---|

| Reach | Potentially global, targeted reach | Geographic limitations, potentially less targeted |

| Cost | Potentially lower long-term cost, variable initial investment | Higher upfront costs, generally fixed costs |

| Measurability | High, detailed analytics available | Lower, often less granular data |

| Engagement | Interactive, allows for two-way communication | Generally one-way communication |

| Customization | High level of customization possible | Limited customization options |

| Examples | , social media marketing, email marketing, paid advertising, content marketing | Print advertising, direct mail, networking events, industry publications |

| Suitability for Accounting Firms | Ideal for building brand awareness, generating leads, and providing client support | Effective for establishing local presence and building personal relationships |

This table illustrates the contrasting strengths and weaknesses of different marketing approaches. Accounting firms can effectively leverage a mix of digital and traditional strategies to maximize their reach and achieve their marketing objectives. Digital marketing allows for detailed tracking of results and engagement, whereas traditional methods often build strong personal connections and local credibility.

Identifying Key Target Audiences

Understanding your ideal client is paramount to effective marketing. Knowing who you’re talking to, what motivates them, and what problems they face allows for tailored messaging and campaigns that resonate deeply. This crucial step informs every marketing decision, from content creation to advertising strategies. This section delves into identifying the key target audiences for accounting and financial services firms, analyzing their unique needs and pain points.

Primary Target Audiences

Accounting and financial services firms cater to a diverse range of clients. Recognizing and segmenting these audiences is vital for crafting effective marketing strategies. Primary target audiences include small business owners, entrepreneurs, high-net-worth individuals, and corporations. Each group has distinct characteristics, needs, and motivations.

Thinking about top 5 marketing initiatives for accounting financial services firms? It’s crucial to stay ahead of the curve, and with Google now offering the ability to automatically delete your search history ( google will now let you auto delete searching data ), this highlights the importance of focusing on a robust online presence. Crafting compelling content, targeted advertising, and building a strong online reputation remain key strategies for success in this evolving digital landscape.

Unique Needs, Pain Points, and Motivations

- Small Business Owners: Small business owners often face challenges like managing cash flow, complying with regulations, and seeking strategic financial advice. Their primary motivations include increasing profitability, improving efficiency, and securing future growth. They often prioritize accessibility and affordability in their financial solutions.

- Entrepreneurs: Entrepreneurs are driven by innovation and growth. They frequently require specialized financial guidance tailored to their unique business models and high-growth aspirations. Pain points often include securing funding, managing risk, and navigating complex financial regulations.

- High-Net-Worth Individuals: High-net-worth individuals require sophisticated financial planning, wealth management, and investment strategies. Their primary motivations include wealth preservation, estate planning, and philanthropic endeavors. They value personalized service, discretion, and expertise.

- Corporations: Corporations need comprehensive financial solutions, including accounting, tax preparation, audit services, and risk management. Their primary motivations are optimized financial performance, compliance with regulations, and sustained growth. They often prioritize efficiency, scalability, and data-driven insights.

Importance of Audience Segmentation, Top 5 marketing initiatives for accounting financial services firms

Segmenting the target audience is critical for effective marketing campaigns. Tailoring messages and strategies to specific needs and pain points leads to higher engagement and conversion rates. For example, a marketing campaign targeting small business owners might emphasize affordable services and practical solutions, while a campaign for high-net-worth individuals would highlight personalized service and discretion. This targeted approach ensures marketing resources are allocated effectively, resulting in a higher return on investment.

Target Audience Segmentation Table

| Target Audience Segment | Demographics | Psychographics | Behavioral Characteristics |

|---|---|---|---|

| Small Business Owners | Typically aged 25-55, self-employed, possess limited financial knowledge. | Goal-oriented, practical, risk-averse, value time efficiency. | Frequently use online resources, seek quick solutions, value affordability. |

| Entrepreneurs | Typically aged 25-45, innovative, ambitious, self-motivated. | Visionary, growth-oriented, value innovation, seek cutting-edge solutions. | Highly engaged online, seek personalized support, value expertise. |

| High-Net-Worth Individuals | Typically aged 45+, high income, significant assets. | Sophisticated, discreet, value exclusivity, seek personalized service. | Seek personalized solutions, value discretion, utilize sophisticated financial tools. |

| Corporations | Large organizations, diverse employee base, various business functions. | Strategic, data-driven, value efficiency, prioritize compliance. | Utilize accounting software, prioritize detailed reporting, seek scalable solutions. |

Evaluating Existing Marketing Practices: Top 5 Marketing Initiatives For Accounting Financial Services Firms

Accounting and financial services firms are often slow to adapt to modern marketing trends. This can lead to missed opportunities and reduced client acquisition. Understanding the strengths and weaknesses of current practices is crucial for crafting effective strategies that resonate with today’s clients. Analyzing past successes and failures can illuminate areas for improvement and highlight the importance of staying ahead of the curve.

Current Marketing Strategies and Tactics

Many accounting and financial services firms still rely heavily on traditional marketing methods like print advertising, referrals, and networking events. While these methods can be effective, they often lack the targeted reach and measurable results of digital marketing. This reliance on traditional approaches can be a significant obstacle to growth in a market increasingly dominated by online interactions and digital platforms.

Firms need to embrace a multifaceted approach, incorporating digital strategies alongside traditional methods.

Strengths of Existing Approaches

Despite their limitations, traditional methods possess certain strengths. Referrals, for example, often lead to highly qualified leads, and networking events provide opportunities for face-to-face interaction and relationship building. These methods can foster trust and credibility, especially in industries where clients value personal connections. The long-standing relationships developed through traditional approaches can be a powerful asset. These established connections often translate to long-term client retention and repeat business.

Weaknesses of Existing Approaches

Traditional marketing methods often struggle with targeted reach and measurable results. Print advertising, for instance, has a broad audience, making it difficult to precisely target specific demographics or client needs. The lack of data analysis also makes it hard to assess campaign effectiveness. This lack of tracking and data-driven insights can result in wasted resources and ineffective campaigns.

Additionally, traditional approaches often lack the agility needed to adapt to rapidly evolving market trends. Firms that fail to incorporate modern strategies may find themselves lagging behind competitors.

Successful Marketing Campaigns

Successful campaigns often leverage a blend of traditional and digital approaches. A firm that successfully implemented a multi-channel approach using a blog, email marketing, and targeted social media advertising to generate leads and build trust, then followed up with personalized networking events for lead conversion. They effectively integrated various strategies to create a holistic marketing experience.

Unsuccessful Marketing Campaigns

Campaigns that solely rely on print advertising and lack digital components often fail to attract a younger demographic. A firm that invested heavily in print advertisements, ignoring the importance of social media and , experienced a significant drop in online visibility and lost potential clients who preferred online interactions. Another example is a firm that used a generic marketing message across all platforms without tailoring the messaging to specific client needs, leading to disengagement and a lack of conversions.

The absence of targeted campaigns and a failure to adapt to client preferences were key factors in their underperformance.

Common Marketing Mistakes

Avoiding generic and unfocused marketing messages is critical. Firms should avoid blanket approaches that fail to resonate with specific client segments. Another frequent error is neglecting digital marketing channels, which can severely limit reach and visibility in today’s digital landscape. Failure to track and analyze marketing data prevents firms from identifying what works and what doesn’t, leading to ineffective allocation of resources.

- Failing to understand and target the right audience segments. This results in misdirected efforts and wasted resources.

- Ignoring data analysis and neglecting the measurement of marketing campaign effectiveness. Without data, it’s impossible to optimize campaigns for better results.

- Lack of adaptability to evolving marketing trends. Sticking to outdated methods limits the firm’s ability to reach new clients and compete effectively.

- Insufficient budgeting for marketing efforts. A lean marketing budget can hinder the ability to execute effective strategies and reach the desired audience.

Designing Top 5 Marketing Initiatives

Now that we’ve defined the scope of our marketing initiatives, identified key target audiences, and evaluated existing practices, it’s time to delve into the heart of the matter: crafting effective strategies to reach and engage our ideal clients. These initiatives are designed to not only attract new business but also strengthen relationships with existing clients, ultimately boosting revenue and profitability.

Top 5 Marketing Initiatives for Accounting & Financial Services Firms

These initiatives focus on a multi-faceted approach, encompassing digital marketing, content creation, and relationship building. Each initiative is designed to deliver measurable results, contributing to a comprehensive marketing strategy that resonates with the target audience.

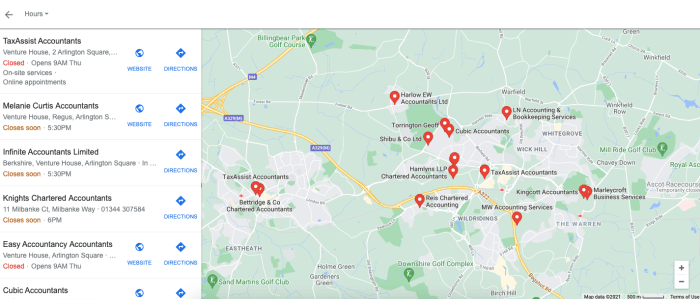

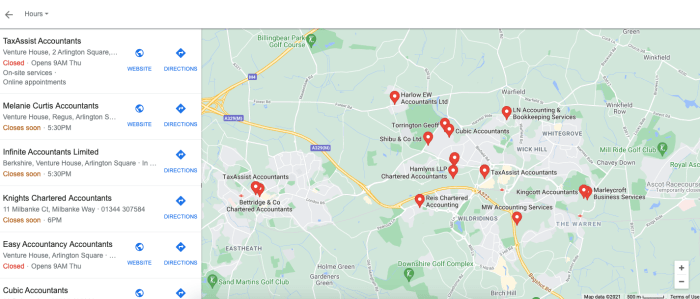

Initiative 1: Building a Robust Online Presence

A strong online presence is paramount in today’s digital landscape. This initiative focuses on creating a website and utilizing search engine optimization () techniques to improve visibility and attract organic traffic. Utilizing a content management system (CMS) allows for easy updates and management of the website content. We’ll also establish a strong social media presence, tailoring content to different platforms and engaging with potential clients.

Thinking about top 5 marketing initiatives for accounting financial services firms? A key element often overlooked is website optimization. Don’t forget about the crucial impact of website redesigns on SEO performance. For example, consider how things like broken links, content migration issues, or neglecting metadata updates can significantly impact your search engine rankings. Understanding these potential pitfalls, as outlined in this helpful guide on 5 things that can affect SEO performance during website redesigns , is vital to any effective marketing strategy.

Ultimately, a strong online presence built on a well-optimized website remains a cornerstone of successful marketing for accounting and financial services firms.

- Strategies: Develop a user-friendly website with clear navigation, detailed service descriptions, and client testimonials. Implement strategies, including research and optimization, to enhance search engine rankings.

- Tactics: Optimize website content for relevant s. Build high-quality backlinks. Regularly publish valuable blog posts, articles, and other content. Create engaging social media profiles on relevant platforms (LinkedIn, Twitter, etc.).

- Channels: Website, search engines (Google, Bing), social media platforms (LinkedIn, Twitter, Facebook).

- Potential ROI: Increased website traffic, higher lead generation, improved brand awareness, and potentially higher conversion rates. Example: A firm focusing on small business accounting saw a 30% increase in qualified leads after implementing a robust online presence strategy.

Initiative 2: Content Marketing for Thought Leadership

Content marketing positions the firm as a trusted advisor and expert in the field. By consistently providing valuable content, we build authority and attract a qualified audience.

- Strategies: Create informative and engaging content such as blog posts, white papers, webinars, and case studies. Focus on topics that resonate with the target audience and demonstrate expertise.

- Tactics: Develop a content calendar outlining topics and publishing schedules. Collaborate with industry influencers to increase visibility and reach. Optimize content for search engines.

- Channels: Website blog, industry publications, social media, email marketing.

- Potential ROI: Increased brand awareness, enhanced credibility, generation of qualified leads, and long-term client engagement. Example: A firm providing tax services saw a 25% increase in client inquiries after implementing a strategic content marketing campaign.

Initiative 3: Targeted Email Marketing Campaigns

Email marketing is a direct and cost-effective way to nurture leads and maintain relationships with existing clients.

- Strategies: Develop targeted email campaigns that provide value to subscribers. Segment the email list to deliver personalized content.

- Tactics: Use email automation tools to nurture leads. Include calls to action in emails. Regularly analyze email performance and optimize campaigns.

- Channels: Email marketing platforms (Mailchimp, Constant Contact). Direct mail (in conjunction with email). Automated email sequences for nurturing leads.

- Potential ROI: Improved lead nurturing, increased client engagement, and higher conversion rates. Example: A firm using email marketing saw a 15% increase in client retention after implementing personalized email sequences.

Initiative 4: Strategic Partnerships and Networking

Strategic partnerships with complementary businesses and active networking can broaden reach and expand the client base.

- Strategies: Identify and partner with businesses that align with the firm’s values and target audience.

- Tactics: Attend industry events and conferences. Participate in networking opportunities. Develop collaborative marketing materials.

- Channels: Industry events, conferences, professional organizations, online networking platforms.

- Potential ROI: Expanded network of potential clients, access to new referral sources, and increased brand visibility. Example: A firm partnering with a local real estate agency saw a 10% increase in referrals.

Initiative 5: Performance-Based Advertising

Utilizing paid advertising channels can significantly boost visibility and attract high-quality leads.

- Strategies: Utilize paid advertising platforms like Google Ads or social media ads to target specific demographics and interests.

- Tactics: Implement A/B testing to optimize ad campaigns. Track key metrics like click-through rates and conversions.

- Channels: Google Ads, social media advertising (LinkedIn, Facebook), pay-per-click (PPC) advertising.

- Potential ROI: Increased website traffic, high-quality lead generation, and faster conversion rates. Example: A firm using targeted advertising campaigns saw a 20% increase in qualified leads within a quarter.

Measuring and Analyzing Marketing Performance

Tracking the success of marketing initiatives is crucial for optimizing strategies and achieving desired outcomes. Without robust measurement and analysis, it’s impossible to understand what’s working, what’s not, and how to refine campaigns for better results. This is especially vital in the financial services industry, where trust and accountability are paramount.Effective marketing measurement allows accounting firms to demonstrate ROI, justify budget allocations, and adapt to evolving market dynamics.

Understanding the key performance indicators (KPIs) and employing suitable analysis methods is essential for successful campaign management.

Key Performance Indicators (KPIs) for Marketing Initiatives

Understanding the specific metrics to track is critical for evaluating the success of each marketing initiative. This requires a tailored approach, considering the unique goals and target audiences of each campaign. For example, a campaign focused on lead generation will prioritize different KPIs than one aimed at brand awareness.

- Lead Generation Campaigns: Track the number of qualified leads generated, conversion rates from leads to appointments, and the cost per lead.

- Brand Awareness Campaigns: Monitor social media engagement, website traffic, brand mentions, and sentiment analysis to gauge public perception.

- Client Acquisition Campaigns: Measure the number of new clients acquired, the lifetime value (LTV) of new clients, and the cost per acquisition (CPA).

- Content Marketing Campaigns: Evaluate website traffic, engagement with content (time spent on page, downloads, shares), and the number of qualified leads generated through content.

- Retargeting Campaigns: Assess click-through rates, conversion rates, and cost per click to evaluate the effectiveness of reaching previous website visitors.

Methods for Measuring Marketing Effectiveness

Beyond identifying the appropriate KPIs, firms need a structured approach for gathering and analyzing the data. This includes employing a combination of analytical tools and techniques.

- Website Analytics: Utilize tools like Google Analytics to monitor website traffic, user behavior, and conversion rates. This allows for detailed insights into campaign performance, including the source of traffic and the effectiveness of landing pages.

- CRM Systems: Leverage customer relationship management (CRM) systems to track interactions with leads and clients. This allows for a comprehensive view of the sales funnel, identifying bottlenecks and optimizing the conversion process.

- Social Media Analytics: Employ social listening tools and social media analytics dashboards to monitor brand mentions, sentiment, engagement rates, and reach. This enables a real-time understanding of public perception and potential areas for improvement.

- A/B Testing: Conduct A/B tests on different marketing materials (e.g., email subject lines, ad copy) to determine which variations perform best. This data-driven approach helps optimize campaigns for maximum impact.

- Surveys and Feedback: Implement customer surveys and feedback mechanisms to gather direct insights into customer experiences and preferences. This allows for a deeper understanding of client needs and how marketing initiatives align with their expectations.

Importance of Ongoing Monitoring and Adjustment

Marketing performance is not a static state; it requires constant monitoring and adaptation. Analyzing data and making adjustments in real-time allows for improved ROI and better alignment with business objectives.

- Real-Time Adjustments: Recognizing trends and making necessary changes to campaigns based on performance data allows for optimal resource allocation and a higher likelihood of achieving campaign goals.

- Performance Improvement: Continuously monitoring campaigns enables the identification of areas for improvement. This can include refining messaging, adjusting targeting, or optimizing ad spend.

- Data-Driven Decision Making: Leveraging performance data for strategic decisions empowers accounting firms to make informed choices and ensure that marketing initiatives align with overall business goals.

Reporting Methods and Dashboards

Effective reporting is critical for demonstrating the value of marketing initiatives. This requires a structured approach to track and analyze performance.

| Reporting Method | Dashboard Focus | Key Metrics |

|---|---|---|

| Weekly Performance Reports | Campaign progress and immediate performance adjustments | Conversion rates, cost per lead, website traffic, social media engagement |

| Monthly Performance Reports | Comprehensive overview of campaign performance | Overall campaign ROI, customer acquisition cost (CAC), customer lifetime value (CLTV) |

| Quarterly Performance Reports | Strategic insights and future campaign planning | Market trends, competitor analysis, impact on revenue |

Illustrating Effective Strategies

Crafting a successful marketing strategy for accounting and financial services firms requires a deep understanding of the target audience, existing market trends, and the firm’s unique value proposition. Effective strategies not only raise brand awareness but also drive tangible results like increased revenue and client acquisition. This section delves into a compelling case study to illustrate these principles in action.

A Case Study: Targeted Digital Marketing for a Mid-Sized CPA Firm

This case study examines how a mid-sized CPA firm, “Apex Accounting,” leveraged digital marketing to attract new clients and enhance its brand presence. Apex recognized the growing importance of online visibility and sought to differentiate itself from competitors.

Defining Apex Accounting’s Goals and Objectives

Apex Accounting’s primary goals were to increase brand awareness, generate qualified leads, and expand its client base within the tech startup community. They focused on attracting entrepreneurs and small business owners seeking expert financial guidance. The objectives included driving website traffic by 30% and securing 15 new clients within a six-month period.

Implementing the Targeted Digital Marketing Strategy

Apex’s strategy involved creating a dedicated website optimized for search engines (), focusing on s relevant to tech startups and entrepreneurs. They developed targeted content marketing, such as blog posts, webinars, and downloadable guides, addressing common financial challenges faced by this demographic. Paid advertising campaigns on LinkedIn and specialized startup networking platforms were also crucial.

Impact on Revenue Generation and Client Acquisition

The initiative yielded impressive results. Within six months, website traffic increased by 45%, and the firm secured 20 new clients. Revenue from these new clients contributed significantly to the firm’s overall financial performance, exceeding the initial objectives. The digital marketing campaign proved to be a valuable tool for client acquisition and revenue generation.

Key Takeaways

“Apex Accounting’s success demonstrates the power of targeted digital marketing in the financial services sector. By focusing on specific needs of a niche market and employing a multi-faceted approach, the firm achieved significant growth and strengthened its market position. This approach highlights the importance of understanding the target audience and tailoring the marketing message to resonate with their specific needs and pain points.”

Illustrating Ineffective Strategies

Marketing initiatives, while often promising, can sometimes fall flat. Understanding why certain strategies fail is crucial for refining future campaigns and achieving desired results. A critical component of a successful marketing strategy is recognizing and learning from past mistakes. This section will delve into a specific case study of a failed marketing initiative to illuminate the potential pitfalls and offer valuable lessons.

A Case Study in Mismatched Messaging

A mid-sized accounting firm, “Precision Financial,” decided to target a younger demographic using a social media campaign focused on trendy, abstract visual elements. Their existing brand identity, however, was rooted in traditional, conservative values. The result was a confusing and ultimately ineffective campaign.

Reasons for Failure

The campaign failed due to several factors. First, the firm’s target audience analysis was inaccurate. While the firm believed a younger audience would engage with the unique visuals, it failed to consider their existing brand image. Secondly, the messaging lacked clarity. The visuals, while appealing to some, did not effectively communicate the firm’s core value proposition or expertise in accounting.

The disjointed brand image and messaging alienated the firm’s existing client base, who valued the firm’s established reputation.

How Precision Financial Could Have Improved the Initiative

Precision Financial could have avoided these pitfalls by focusing on a more targeted approach. Instead of attempting to overhaul their entire brand image, they could have introduced a separate, niche social media campaign targeting the younger demographic while maintaining their core brand identity. This approach would have provided a more cohesive experience for all target segments, fostering trust and engagement.

They could have also used targeted ads that focused on the specific needs and concerns of the younger audience, rather than using generic visual themes.

Lessons Learned

“A mismatched brand image and messaging can alienate both existing and potential clients. Focus on a targeted approach that maintains brand consistency and effectively communicates the firm’s unique value proposition.”

Conclusion

In conclusion, crafting a winning marketing strategy for accounting and financial services firms requires a multifaceted approach. Understanding your target audience, evaluating existing practices, and developing innovative initiatives are key elements. By following the strategies Artikeld in this article, firms can build a strong brand presence, attract clients, and achieve sustainable growth. The successful case studies and the lessons learned from failures will provide valuable insights to apply in your own marketing efforts.

Remember to continually measure and adjust your strategy to maximize results.