What is a perfectly competitive market? It’s a market structure where numerous buyers and sellers interact, all trading identical products. Understanding this dynamic is key to grasping market forces and how businesses behave within them. From defining the characteristics that set it apart from other market types to analyzing its implications on efficiency and welfare, this exploration dives deep into the intricacies of perfect competition.

This comprehensive guide examines the key features of a perfectly competitive market, including the role of numerous buyers and sellers, homogeneous products, free entry and exit, and the absence of significant barriers to entry. It also discusses the implications of perfect competition on firm behavior, the concepts of price takers, allocative efficiency, and consumer surplus. Finally, the guide explores the short-run and long-run equilibrium conditions for a firm in a perfectly competitive market, examining the relationship between price and marginal cost and the role of economic profits and losses in driving entry and exit.

Furthermore, we’ll delve into real-world examples and the limitations of this theoretical model, considering its implications on market efficiency and welfare.

Defining Perfect Competition

Perfect competition, a cornerstone of microeconomic theory, represents a market structure where numerous buyers and sellers interact to determine the price and quantity of a homogeneous product. It’s an idealized model, rarely found in its purest form in the real world, yet it provides a valuable framework for understanding market dynamics and evaluating other market structures.This theoretical model simplifies market complexities to isolate the impact of specific forces on market outcomes.

By understanding the assumptions and characteristics of perfect competition, we can better grasp how markets function and the conditions that lead to optimal resource allocation.

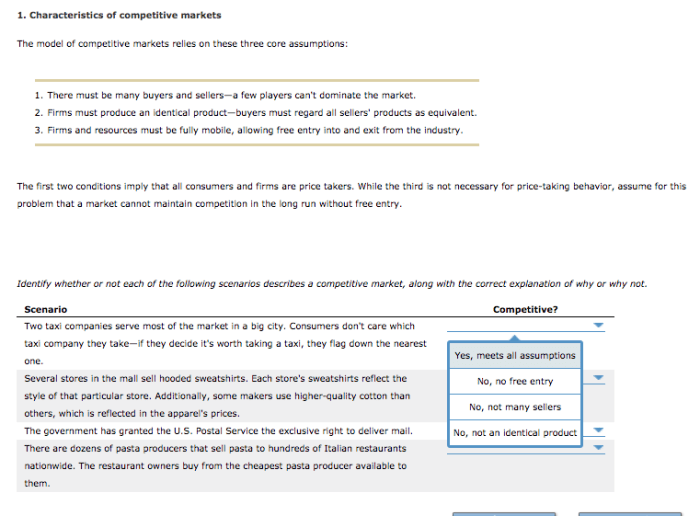

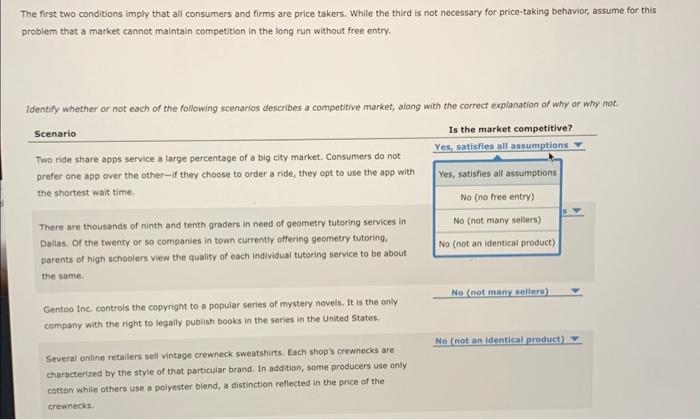

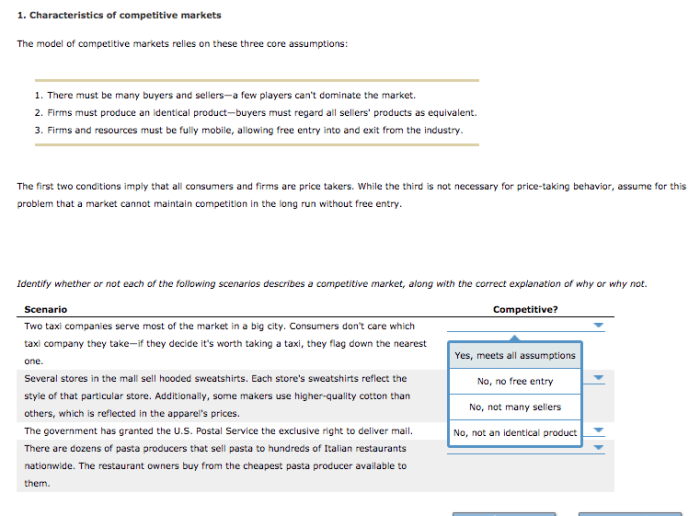

Characteristics of Perfect Competition

Understanding perfect competition requires recognizing its key characteristics. These characteristics, while rarely perfectly realized in real-world markets, provide a benchmark for evaluating real-world market structures.

- Large Number of Buyers and Sellers: A large number of buyers and sellers ensure that no single entity has significant influence over the market price. Each participant is a “price taker,” meaning they must accept the prevailing market price. This prevents any individual from manipulating prices.

- Homogenous Product: The products offered by all sellers are identical or nearly identical. Consumers perceive no difference between products from different sellers, fostering competition based solely on price. This eliminates the role of branding or product differentiation.

- Free Entry and Exit: Firms can enter or exit the market without significant barriers. This ensures that profits are competed away in the long run, and firms cannot sustain economic profits.

- Perfect Information: All participants have complete and instantaneous knowledge of the market price, product quality, and production costs. This eliminates any information asymmetry that might allow some participants to gain an unfair advantage.

- No External Factors: Factors like government regulations, taxes, or externalities are not considered in the basic model. This assumption simplifies the analysis by focusing solely on market interactions.

Assumptions of Perfect Competition

The perfect competition model relies on a set of assumptions to simplify market analysis. These assumptions, though often unrealistic, provide a useful framework for understanding the forces at play in market structures.

- Rationality of Participants: All buyers and sellers are assumed to act rationally, aiming to maximize their own self-interest. This assumption simplifies decision-making processes.

- No Collusion: Firms are not able to collude or cooperate to manipulate market prices. This assumption is critical to maintaining the competitive nature of the market.

- Absence of Government Intervention: The model assumes that there is no government intervention in the market, such as price controls or subsidies. This allows for a focus on the forces of supply and demand.

Examples of Industries with Competitive Characteristics

While few industries perfectly match all the characteristics of perfect competition, some exhibit features that are remarkably close. These real-world examples highlight the applicability of the model, even if only in parts.

- Agricultural Markets (e.g., wheat, corn): The sheer volume of producers and the standardized nature of the products often create conditions close to perfect competition, especially for commodities. Though not completely free of influences, many agricultural markets operate with numerous participants and homogeneous products.

- Foreign Exchange Markets: The global nature of currency trading and the high volume of transactions often lead to rapid price discovery and near-instantaneous information dissemination. This environment allows for significant competition.

- Online Retail Markets (e.g., for generic products): The ease of entry and the large number of sellers in online marketplaces can create a highly competitive environment. This competition often drives prices down to levels closer to the theoretical model of perfect competition.

Comparison of Market Structures

| Characteristic | Perfect Competition | Monopoly | Oligopoly | Monopolistic Competition |

|---|---|---|---|---|

| Market Structure | Many small firms, homogeneous product | Single firm, unique product | Few large firms, differentiated or homogeneous product | Many firms, differentiated products |

| Pricing Power | None (price takers) | Significant (price makers) | Some (interdependent pricing) | Limited (some product differentiation) |

| Output | Efficient (allocative and productive efficiency) | Inefficient (potential for deadweight loss) | Potentially efficient or inefficient (depends on competition) | Efficient (potentially allocatively inefficient) |

Market Characteristics

Perfectly competitive markets are characterized by specific features that influence how prices are determined and how firms operate. Understanding these features is crucial for analyzing market behavior and predicting outcomes. This section delves into the key characteristics, exploring the implications of numerous participants, homogeneous products, and the ease of entry and exit for firms.

Numerous Buyers and Sellers

The presence of numerous buyers and sellers is a defining characteristic of a perfectly competitive market. This abundance of participants means no single buyer or seller can influence the market price. Each individual actor is a price taker, accepting the prevailing market price as given. Imagine a farmer selling wheat; the farmer can’t raise the price or drastically reduce the supply because there are many other farmers selling wheat at the same market price.

The large number of buyers ensures the market is robust and dynamic, with constant interaction between supply and demand.

Homogenous Products

A key aspect of perfect competition is the homogeneity of the products offered. Identical or nearly identical products are available from all sellers, creating no perceived differences in quality or features. In the wheat market example, all wheat is considered the same, regardless of the farmer. This homogeneity implies perfect substitutability between products, further solidifying the price-taking nature of participants.

Consequently, the focus is entirely on price, not product differentiation.

Free Entry and Exit of Firms in the Long Run

In the long run, firms can freely enter or exit a perfectly competitive market without facing significant barriers. This dynamic nature ensures that firms are incentivized to enter when profits are high and exit when losses persist. The ease of entry and exit is a powerful mechanism for self-regulation, ensuring the market operates efficiently. If one industry is very profitable, new companies will enter to take advantage of that, driving down prices and profits until they return to normal levels.

A perfectly competitive market, in theory, is one where numerous buyers and sellers interact, leading to a single, market-determined price. This is a crucial concept, but in the real world, businesses often need to drive more foot traffic to thrive. Ultimately, understanding the theoretical model of perfect competition helps businesses better strategize and adapt to real-world market dynamics.

Barriers to Entry

Barriers to entry prevent a market from operating as perfectly competitive. These impediments can take various forms, including substantial capital requirements, complex regulations, or unique resources. For example, the airline industry often has high capital costs for purchasing planes and establishing infrastructure, making it challenging for new entrants. Patents and licensing restrictions in industries like pharmaceuticals or telecommunications can also restrict entry, moving the market away from the idealized state of perfect competition.

These barriers can create market power and prevent the free flow of competition.

Characteristics of Perfect Competition

| Characteristic | Description |

|---|---|

| Nature of the Product | Homogenous; identical or nearly identical across all sellers. |

| Number of Buyers and Sellers | Many; no single buyer or seller can influence the market price. |

| Barriers to Entry | Low or non-existent; firms can easily enter and exit the market. |

| Control over Price | None; firms are price takers, accepting the prevailing market price. |

Implications of Perfect Competition: What Is A Perfectly Competitive Market

Perfect competition, a theoretical market structure, presents a fascinating case study in economic theory. It provides a benchmark against which other market structures can be compared, highlighting the ideal conditions for consumer welfare and allocative efficiency. Understanding its implications sheds light on how firms behave under these stringent assumptions and how the market functions in such a streamlined environment.Firms in a perfectly competitive market face a unique set of constraints and incentives.

These conditions profoundly shape their behavior and ultimately impact the overall market dynamics. This section will explore these implications, from the concept of price-taking to the achievement of allocative efficiency and its effect on consumer surplus.

Firm Behavior in Perfect Competition

Perfectly competitive firms operate under the crucial assumption of price-taking. This means they have no control over the market price. The sheer number of competitors ensures that any individual firm’s output decision has a negligible impact on the overall market supply. Their sole focus becomes optimizing production at the most profitable output level given the prevailing market price.

They are, in essence, small players in a large game where the rules are dictated by market forces, not by individual firm actions.

Price Takers in a Perfectly Competitive Market

The concept of price-taking is fundamental to understanding perfect competition. A price taker is a firm that must accept the market price as given. They cannot influence the price by changing their output. This stems from the numerous competitors in the market. If a firm tries to charge a higher price, consumers will readily switch to other, equally priced, products.

This characteristic forces firms to compete primarily on efficiency and cost reduction to maximize their profits.

Allocative Efficiency and Perfect Competition

Perfect competition plays a crucial role in achieving allocative efficiency. Allocative efficiency occurs when resources are allocated to produce goods and services that consumers value most. In a perfectly competitive market, the market price reflects the marginal cost of production. This ensures that the resources are used to produce goods and services that consumers are willing to pay for at the price that reflects the resources used to create them.

The resulting output level satisfies the condition of allocative efficiency where the price equals the marginal cost.

A perfectly competitive market, in theory, has many buyers and sellers, all offering identical products. Understanding this is crucial for crafting effective marketing strategies, like the 8 techniques that’ll double your Google AdWords conversion rate, 8 techniques thatll double your google adwords conversion rate. Ultimately, knowing your target market and product offerings within a competitive landscape is key for success in any market, perfectly competitive or otherwise.

Perfect Competition and Consumer Surplus

Consumer surplus, a measure of consumer welfare, is maximized in a perfectly competitive market. When the market price equals the marginal cost, consumers are able to purchase goods at a price that reflects the minimal cost to society. This results in a larger consumer surplus compared to other market structures where prices might be higher than the marginal cost of production.

This maximization is a key aspect of the market’s efficiency in allocating resources.

Equilibrium Conditions for a Firm in Perfect Competition

| Equilibrium Condition | Short Run | Long Run | Graph Description |

|---|---|---|---|

| Output Level | Where Marginal Revenue (MR) = Marginal Cost (MC) | Where Price (P) = Marginal Cost (MC) = Average Total Cost (ATC) | A graph showing the firm’s marginal cost (MC) curve intersecting the marginal revenue (MR) curve. The output level where these curves intersect represents the profit-maximizing output for the firm in the short run. In the long run, the firm’s average total cost (ATC) curve also intersects the price (P) line at the same output level, indicating that the firm is making zero economic profit. |

| Profit | Positive, zero, or negative, depending on the relationship between price and average total cost (ATC) | Zero economic profit | A graph depicting the firm’s short-run cost curves (MC, ATC, AVC). The area between the price line and the ATC curve represents the firm’s profit (or loss) in the short run. In the long run, the price must equal the minimum point of the ATC curve for the firm to make zero economic profit. |

The short-run equilibrium occurs when a firm produces where marginal revenue equals marginal cost. The long-run equilibrium occurs when a firm produces where price equals marginal cost and equals average total cost, indicating zero economic profit.

Short-Run and Long-Run Equilibrium

In a perfectly competitive market, firms operate under specific conditions that affect their behavior in the short and long run. Understanding these equilibrium states is crucial for comprehending market dynamics and firm profitability. A crucial aspect of this understanding involves analyzing how firms adjust their production levels and pricing strategies to maximize profits, considering factors like input costs and market demand.

Short-Run Equilibrium

The short-run equilibrium for a firm in a perfectly competitive market is characterized by a specific relationship between price and marginal cost. The firm maximizes its short-run profits by producing the output level where the price equals the marginal cost (P = MC). This condition ensures that the firm is neither losing money nor generating additional profits by increasing or decreasing output.

Relationship Between Price and Marginal Cost

A firm in short-run equilibrium will produce at a level where the price of the good equals the marginal cost (P = MC). This equality is crucial for profit maximization. If the price exceeds the marginal cost, the firm can increase its profits by producing more. Conversely, if the price is less than the marginal cost, the firm can increase its profits by reducing production.

Long-Run Equilibrium

In the long run, the competitive pressures in a perfectly competitive market lead to a different equilibrium state. The key characteristic of long-run equilibrium is that economic profits are zero. This zero-profit condition arises from the ability of firms to enter and exit the market. If economic profits exist, new firms are incentivized to enter, increasing supply and driving down prices until profits disappear.

Conversely, if firms are experiencing economic losses, some firms will exit the market, decreasing supply and pushing prices back up until losses are eliminated.

Role of Economic Profits and Losses

Economic profits and losses play a critical role in driving entry and exit of firms in the long run. When firms earn positive economic profits, new firms are attracted to the market, leading to an increase in supply. This increased supply eventually drives down the price of the product, reducing the economic profits of existing firms until they are zero.

Conversely, if firms experience economic losses, some firms will exit the market, reducing the supply of the product and pushing the price back up. This process continues until losses disappear and firms achieve zero economic profit.

Economic profit = Total revenue – Total cost (including implicit costs).

Key Differences Between Short-Run and Long-Run Equilibrium

| Characteristic | Short-Run Equilibrium | Long-Run Equilibrium |

|---|---|---|

| Price | Equals marginal cost (P = MC) | Equals minimum average total cost (P = ATCmin) |

| Economic Profit/Loss | Can be positive, zero, or negative | Zero |

| Number of Firms | Fixed | Variable |

| Firm’s Output | Determined by P = MC | Determined by P = MC = ATCmin |

| Diagrammatic Representation | A firm’s supply curve intersects with the market demand curve at the market equilibrium price. In a diagram, the firm’s marginal cost curve (MC) intersects the market price (P) at the profit-maximizing output level. | In a diagram, the firm’s long-run average total cost (LRATC) curve is tangent to the market price (P). The firm produces at the minimum point of the LRATC curve. |

Efficiency and Welfare Implications

Perfect competition, in theory, is a highly efficient market structure. Its characteristics, like numerous buyers and sellers, homogeneous products, and free entry and exit, create a dynamic environment that benefits both consumers and producers. This efficiency manifests in various ways, from optimal resource allocation to maximizing overall societal welfare. Understanding these implications is crucial for analyzing market performance and designing effective economic policies.

Allocative Efficiency in Perfect Competition

Perfect competition achieves allocative efficiency by ensuring that resources are allocated to produce goods and services that consumers value most. This occurs when the price of a good reflects its marginal cost. When the price equals the marginal cost (P=MC), society is maximizing the overall benefit derived from the resources used. In simpler terms, the market is producing the optimal quantity of goods and services that consumers are willing to pay for.

Productive Efficiency in Perfect Competition, What is a perfectly competitive market

Perfect competition fosters productive efficiency by encouraging firms to operate at the lowest possible cost. In the long run, firms in a perfectly competitive market operate at their minimum average total cost (ATC). This drive for cost minimization stems from the intense competition, where firms must continually strive to improve efficiency to survive. The pressure to reduce costs leads to innovation and technological advancements.

Welfare Implications of Perfect Competition

The welfare implications of perfect competition are significant. Consumer surplus and producer surplus are maximized. Consumer surplus represents the difference between what consumers are willing to pay and what they actually pay, while producer surplus represents the difference between the price received and the cost of production. The combined consumer and producer surplus represents the total economic surplus, indicating the net benefit to society from the market transaction.

Understanding a perfectly competitive market boils down to a few key characteristics, like many sellers and buyers. But to really connect with your audience on YouTube, you need to optimize your content. Check out these 4 quick wins to increase your YouTube engagement 4 quick wins to increase your YouTube engagement to boost views and build a loyal following.

Ultimately, a competitive market thrives on informed consumers, just like a thriving YouTube channel relies on engaging content.

Limitations of Perfect Competition

While perfect competition is an ideal model, it faces certain limitations in the real world. One key limitation is the difficulty in meeting the assumptions of perfect competition. For example, perfect information is rarely available to all market participants, and products are rarely completely homogeneous. Also, free entry and exit may be restricted due to various factors like high startup costs or government regulations.

Moreover, perfectly competitive markets may not be able to address issues like externalities (e.g., pollution) or public goods effectively.

Efficiency Comparison Across Market Structures

| Market Structure | Allocative Efficiency | Productive Efficiency | Advantages | Disadvantages |

|---|---|---|---|---|

| Perfect Competition | High | High (in the long run) | Maximizes consumer and producer surplus, promotes innovation, allocates resources efficiently. | Rare in the real world, may not address externalities or public goods effectively. |

| Monopoly | Low | Low (often) | May have economies of scale, can lead to innovation. | Reduces consumer surplus, can lead to inefficient resource allocation. |

| Oligopoly | Moderate to Low | Moderate | Potential for economies of scale, some innovation. | Can lead to collusion, limit competition, and reduce consumer surplus. |

| Monopolistic Competition | Moderate | Low (compared to perfect competition) | Variety of products, some competition. | Can lead to excess capacity, not as efficient as perfect competition. |

The table above provides a comparative overview of the efficiency characteristics of different market structures. The advantages and disadvantages of each structure highlight the trade-offs inherent in market design. It’s crucial to understand that the optimal market structure depends on the specific context and goals of the economy.

Real-World Applications

Perfect competition, while a theoretical ideal, offers a valuable framework for understanding market dynamics. Examining real-world instances where these conditions are approximated helps us appreciate the strengths and weaknesses of this model. Understanding these applications, along with the limitations and government interventions, is crucial for informed economic policy and analysis.

Industries Approximating Perfect Competition

Numerous industries, though not perfectly competitive, exhibit characteristics that bring them close to the theoretical model. These often involve standardized products and a large number of buyers and sellers.

- Agricultural markets for certain commodities like wheat or corn often exhibit characteristics of perfect competition. A large number of farmers produce a standardized product, and individual farmers have little influence on the market price. While not entirely free from market influences, these markets are a good example of a market structure that approximates the theoretical model.

- Foreign exchange markets for certain currencies, particularly those with low transaction costs, can also display features of perfect competition. A multitude of buyers and sellers trade a standardized product (a specific currency pair), and individual traders typically have minimal influence on the exchange rate. However, government interventions and market volatility can disrupt the pure competition.

- Certain online markets for standardized goods, such as generic computer components or some types of consumer electronics, can exhibit characteristics of perfect competition. The sheer number of sellers offering comparable products makes it challenging for any one seller to significantly impact the market price. This often depends on the level of consumer trust and market transparency.

Limitations of Perfect Competition in Real-World Scenarios

The theoretical model of perfect competition often faces challenges in practical application. Several factors hinder the realization of these conditions.

- Perfect information is rarely attainable. Buyers and sellers typically do not possess complete knowledge about the market, including all prices and product qualities. This asymmetry of information can significantly affect the market dynamics.

- Homogeneous products are uncommon in most industries. While some products are standardized, many goods and services are differentiated by features, quality, or branding. This differentiation introduces barriers to entry and allows firms to influence prices.

- Significant barriers to entry often exist in many industries. Establishing a new business or entering a new market frequently involves substantial capital investment, regulatory hurdles, or other constraints. This limits the number of firms in the market and hinders the free entry and exit that is a cornerstone of perfect competition.

Impact of Government Regulations

Government regulations play a significant role in shaping market competitiveness. Regulations can promote or hinder the achievement of perfect competition, depending on their nature.

- Regulations can create barriers to entry by imposing licensing requirements or other restrictions. This limits the number of firms in the market, reducing the degree of competition.

- Regulations designed to protect consumers, such as those addressing product safety or labeling, can promote competition by ensuring fairness and transparency. These regulations can level the playing field for smaller firms.

- Regulations aimed at controlling monopolies or anti-competitive practices can foster more competitive markets. Anti-trust laws, for instance, are designed to prevent firms from colluding or engaging in practices that reduce competition.

Challenges in Achieving Perfect Competition

The realization of perfect competition in practice faces numerous hurdles.

- Achieving perfect information is practically impossible in real-world markets. Information asymmetry, including incomplete knowledge of prices and product characteristics, is pervasive.

- Standardization of products is rare in most industries. Differentiation, branding, and quality variations typically lead to product heterogeneity, impacting market dynamics.

- Significant barriers to entry often limit the number of firms in a market. These barriers include high capital requirements, complex regulatory processes, or established brand recognition.

Comparison of Real-World Applications

| Industry | Approximation of Perfect Competition | Limitations |

|---|---|---|

| Agricultural markets (e.g., wheat) | High number of producers, standardized product | Government subsidies, weather conditions, and market volatility |

| Foreign exchange markets (e.g., USD/EUR) | Large number of traders, standardized product (currency pair) | Government interventions, speculation, and market fluctuations |

| Online markets (e.g., generic components) | Large number of sellers, standardized products | Information asymmetry, seller credibility, and market manipulation |

Conclusion

In conclusion, a perfectly competitive market, while often an idealized model, provides a crucial framework for understanding market dynamics. It highlights the importance of numerous participants, identical products, and the absence of significant barriers to entry. By understanding these characteristics, we gain insight into how firms behave, and the implications for allocative and productive efficiency, consumer and producer surplus, and the overall welfare of society.

However, it’s essential to recognize the limitations of perfect competition in real-world applications and the impact of various factors that deviate from the theoretical model.